Dry powder, a term originally referring to stashes of reserved gunpowder, has been adopted by private equity to describe money that has not yet been invested. These funds have grown at a blistering rate of nearly 17% per year to reach a record $1.8 trillion in January 2022.

This phenomenal growth has been spurred by several factors, including an increase in fundraising by PE firms, an increase in competition for deals, and a shift in investor preferences from public markets to private equity.

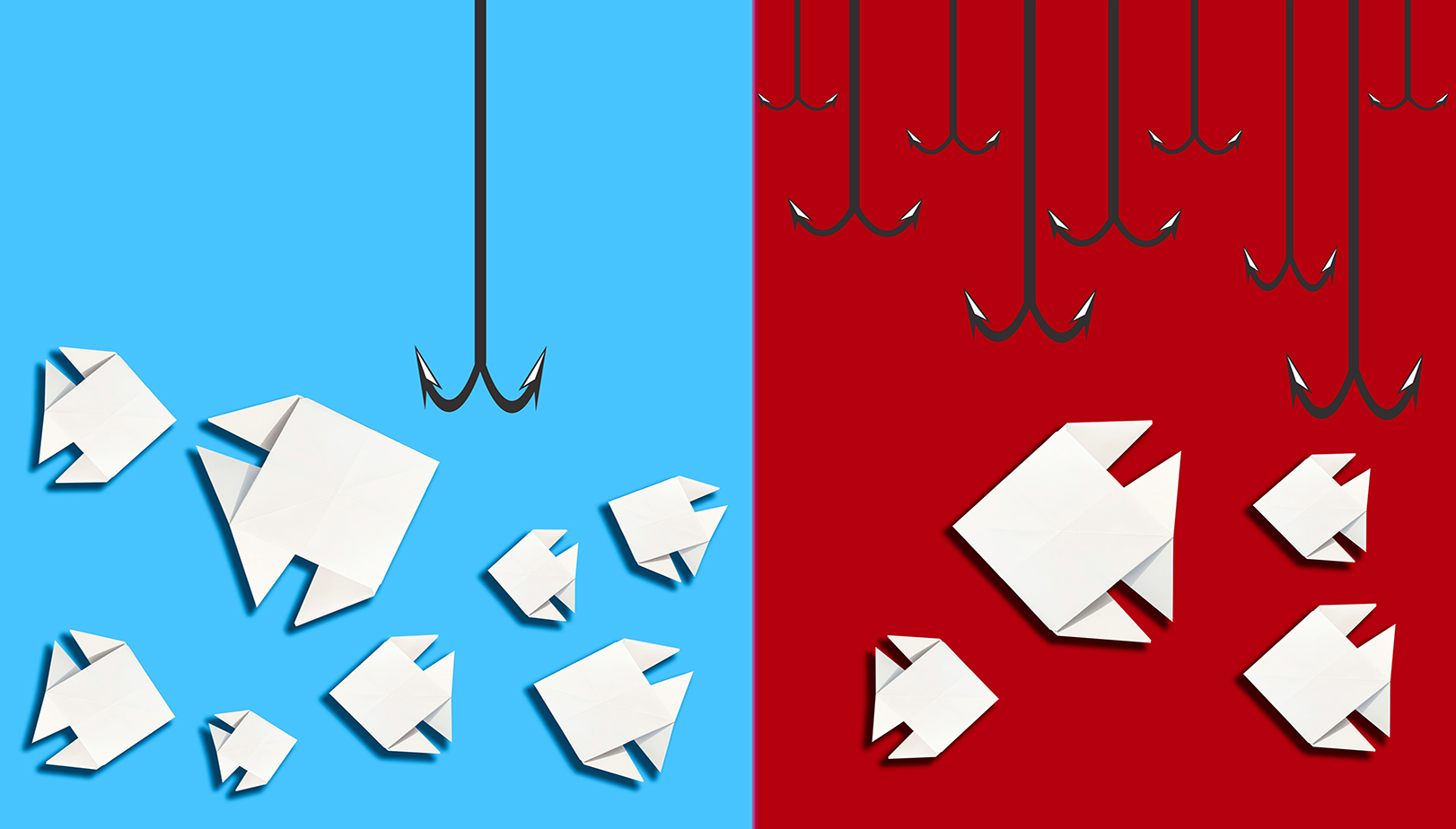

Dry powder can be a double-edged sword for PE firms. On the one hand, it gives them more firepower to win deals and drive up valuations. On the other hand, it puts pressure on them to deploy the money quickly and efficiently or face their investors’ wrath. With nearly $2 trillion of dry powder sitting on the sidelines, competition for deals will only intensify in the coming years.

Smaller Funds Have Less Competition for Great Deals

With the decades-long shift from public to private equity investing, many large institutional investors have poured billions of dollars into the asset class. This has created a competitive bidding environment for deals and increased prices.

Bucking this trend, small private equity funds have received just 1.4% of the total capital raised. The resulting lack of competition with bigger investors has made it easier for smaller PE firms to win and invest in stronger, better-priced deals. In turn, these smaller funds have generated better returns for their investors, partly because they are not under the same pressure to deploy their capital as quickly as their larger counterparts.

The higher returns achieved by small private equity firms are not just a fluke. A research study by the American Economic Association found that fund returns decline with fund size due to the diseconomies of scale in money management.

Additional research found that smaller funds outperformed larger funds by 3.65% per year, and eight of the ten top-performing funds are sized at $100 million or less. Small and medium-sized firms are more nimble and better able to adapt to changing market conditions. This agility enables them to make better investment decisions and generate higher returns for their investors.

Fees on Uninvested Dollars

Limited Partners typically pay a 2% management fee on the total amount of capital committed to a PE fund, regardless of whether that money has been invested. This arrangement incentivizes PE firms to deploy their capital quickly to avoid paying fees on unused funds.

This fee structure is one of the reasons why PE firms have been under pressure to invest in their dry powder. To avoid paying fees on uninvested capital, many firms have been forced to lower their deal-making standards and take on more risk.

Further, this also risks creating an overheated valuation environment, as firms are incentivized to pay more for companies to deploy their dry powder. Once again, small funds are less affected, as they are not under the same pressure to invest their capital.

Early-stage valuations, too, have been less affected by this competitive pressure, seeing recent growth, even as later-stage companies have seen their valuations flatten or decline.

Ultimately, smaller private equity firms have taken advantage of the current market conditions to generate better returns for their investors. Investors seeking superior returns would be wise to consider investing in smaller private equity funds.

Gridline is one such fund that provides access to top-quartile private market alternative investments, historically only available to sophisticated family offices and endowments. By investing transparent, efficient, and lower-costly, investors can gain diversified exposure to non-public assets with low capital minimums and greater liquidity.