The business of sports has never been hotter. Once upon a time sports ownership was considered a trophy asset for local bigwigs, who purchased the team to see and be seen as much to generate a return. While there are still plenty of vanity ownership projects out there (Dallas Cowboys fans can certainly attest to Jerry Jones’ proclivity to make himself the center of attention), the ownership of major sports franchises has become considerably more professionalized over the past decade. After the NFL announced that it would allow private equity funds to purchase stakes in teams a few months ago, it completed a clean sweep of major American leagues who allow funds to invest minority growth capital into teams.

Why are investors interested?

It comes down to eyeballs, which drive dollars. Over the past couple of decades, the rise of streaming and smartphones has sent traditional TV viewership spiraling downward. Only 45% of TV watching households in America still subscribe to cable or satellite, down from a peak of almost 90%. This shift to streaming (which recently topped 40% of TV usage for the first time) depressed viewership for traditional cable, and importantly for advertisers puts a large chunk of viewership out of reach given the no or limited ad models preferred by streamers like Netflix. The result is that sports broadcasts now stand alone as the most viewed TV windows that are open to advertisers, averaging over 91 of the 100 most watched telecasts in 2023 and 2024.

Advertisers are unsurprisingly willing to pay top dollar for this rare content. That in turn means that networks pay the leagues an ever-increasing amount for content, for example NFL rights increased more than fourfold from 2006 to 2022 (the first year of the current contract). These broadcast rights are split amongst the teams, meaning that those team valuations have shot up alongside a bumper crop of revenues. The University of Michigan’s Ross School of Business tracks an index of Sports Franchises in concert with investor Arctos, and they estimate team values have risen at 14% annually over the past 20 years, doubling the annualized return of the S&P 500.

Why are existing owners willing to sell?

If the assets are so great, why are existing owners willing to part with them and make it easier for Private Equity to buy in? Part of the reason is succession planning. As many older owners pass away their children might not be able to or want to continue in a lead ownership role. Another is increased capital expenditures. As stadiums get more and more expensive (the NFL now has 7 stadiums that cost over $1B), existing ownership groups might not have the capital to afford new stadiums without institutional backing. Finally the valuations on teams are getting so high that even the wealthiest individuals don’t have the bankroll to purchase teams on their own or with a limited number of co-investors. Institutional pools of capital are required, hence the multi-billion dollar private equity fundraises.

Is there another way to play it?

While plenty of groups have lined up to take minority stakes in longstanding enterprises, others have sought to avoid the high valuations by purchasing stakes in teams from upstart leagues or creating new competitions from scratch. Monarch Collective and Ariel Investments are great examples of the former, investing exclusively in women’s sports at valuations in the hundreds of millions rather. New leagues abound, from TGL in golf to King’s League in soccer, often using the transformative celebrity of a founder like Tiger Woods or Gerard Piqué to draw eyeballs to a new league offering a less formal wrapper to a well-known sport. Other leagues like LOVB have attempted to put professional structure behind sports that usually receive significant attention around the Olympics, often using social media and behind the scenes footage to connect with fans directly. Plenty of ancillary businesses have benefitted from the rise in sports enterprise values, like data-driven sports marketer Two Circles who has been able to expand into a global sports marketplace. As valuations continue to increase and more professional ownership groups seek to drive value at these teams, it seems likely that outsourced specialists will gain market share from internal franchise by franchise efforts.

Any way you choose to view sports investing, what seems clear is that the business of sports has never been bigger and seems unlikely to slow down anytime soon. Given the dearth of public market opportunities to invest in the sports ecosystem, we remain believers that private markets should be an instrumental part of any sports investor’s toolkit.

When IBM chairman Thomas Watson was selected to serve as ambassador to the USSR in 1979, he had a problem. Ethics norms of the time dictated he needed to dispose of his personal stakes in several VC funds he’d accumulated over years of investing in the early computing industry. Watson tapped Dayton Carr to help market the fund interests. After significant effort, Carr found willing buyers in the nascent private markets ecosystem to complete the sales. This convinced Carr to set up the world’s first dedicated secondaries firm, Venture Capital Fund of America, to pursue the strategy full-time.

The industry Carr helped birth more than four decades ago has spread across every major private market asset class and transacted more than $112B of volume in 2023. Secondaries have become an increasingly important arrow in the quiver of private market allocations available to investors, whether because of competitive returns, diversification, or quicker cash conversion cycles.

We believe now is a particularly advantageous time to tap the secondaries markets with discounts to net asset value above pre-COVID averages across asset classes and even further above average in more niche spaces like venture. To that end, we’ve taken steps to bring high-quality secondaries opportunities to our member community.

I’ve put together a primer on the history of secondaries, different segments that have evolved, and what the data indicates about performance. I invite you to have a read and let me know what you think.

-Charles Patton, Director, Investments

To view and download full details of the funds on our platform and in future emails like these, visit app.gridline.co/signup and answer a few quick questions that allow us to verify your identity and learn about your allocation strategy. There is no cost or commitment to create an account on Gridline.

Many of the same common sense principles for crafting a balanced portfolio that performs over the long term apply across both public and private. Read More

We expect to see investors of all sizes deploy more capital into secondaries. Explore our primer on the category’s history, segments, and performance. Read More

When IBM chairman Thomas Watson was selected to serve as ambassador to the USSR in 1979, he had a problem. Ethics norms of the time dictated he needed to dispose of his personal stakes in several VC funds he’d accumulated over years of investing in the early computing industry. Watson tapped Dayton Carr to help market the fund interests. After significant effort, Carr was able to find willing buyers in the nascent private markets ecosystem to complete the sales. This convinced Carr to set up the world’s first dedicated secondaries firm, Venture Capital Fund of America, to pursue the strategy full-time.1 Carr ended up nurturing several industry luminaries, including Jeremy Coller (CEO of Coller Capital) and Andrew Isnard (CEO of Arcis Group).

Today, the industry Carr helped birth transacted $112B of volume in 2023 and has spread into every private asset class.2 Whether because of competitive returns, diversification, or quicker cash conversion cycles, secondaries have become an increasingly important arrow in the quiver of private market allocations available to investors. This article will walk through two common types of secondaries deals, recent trends in different corners of the market, and things for investors to keep in mind before jumping in.

Watson’s quandary is an example of the original form of secondaries transactions, LP stake sales. These involve Limited Partners (LPs) looking to sell private fund interests and secondaries managers hoping to acquire them for less than their intrinsic value. LPs might be looking to sell because of shifting strategic mandates, idiosyncratic personal factors, loss of conviction in a manager’s strategy, or to free up liquidity. Buyers are tempted by typical discounts to Net Asset Value (NAV) at purchase, a shorter runway to liquidity as typical sales take place in the latter years of a fund’s life, and a mostly known and well-diversified portfolio.

Many private fund contracts require General Partner (GP) consent before interests are transferred, which means the GP must approve LP stake purchasers before any sale. This is especially true for Venture managers, who can be sensitive about allowing new investors into the partnership who might publicize portfolio company information. These dynamics help existing LPs in a fund get a leg up when purchasing stakes, as they can be trusted not to circulate information and are knowledgeable enough about the portfolios to ascertain their true value. Because that pool of LPs is often smaller than buyout funds, bidding for venture portfolios tends to be less competitive.

As secondary markets developed, a pattern of LPs looking to unload interests in long-dated funds emerged. Because fund interests might be a bit small by that stage of a fund’s life, LPs might not get great asset pricing. GPs became aware of this dynamic and introduced continuation funds, where LPs would be given the option to sell their interests in one large block and hopefully fetch a better price. GPs are quite enthusiastic about the prospect as it allows them to reap significant carry when LPs extinguish their fund interests and restart the clock on fee income (which GPs receive from new purchasers in exchange for continued management of the assets). Less cynically, they can also allow GPs to pursue more long-term value enhancement plans rather than forcing assets to market prematurely.

From a purchaser’s perspective, continuation vehicles offer the chance to purchase significant exposure to a concentrated portfolio. Because managers typically run a bidding process for the right to participate, secondaries purchasers can get an opportunity to learn more about the assets they’re purchasing, particularly if they are less familiar with the manager. In the words of one market participant, “Managers can sell these assets to any number of people.”3 This same broadly marketed process usually means more competitive pricing, requiring purchasers to be spot on when forecasting portfolio company growth.

Whether on the LP or GP side, this market environment has been conducive to significant secondaries volume. Jefferies estimates that 2023 was secondaries’ second-largest year behind 2021, with volume fairly evenly split between GP continuation vehicles and LP stake sales.2 LP volume was dominated by Pensions and Sovereign Wealth Funds, which is perhaps unsurprising as they are the largest individual pools of capital. On the GP side, higher rates made the traditional exit routes of IPOs, M&A, and dividend recaps scarce, creating a strong opportunity for continuation funds to provide liquidity. Continuation funds reached an all-time high of 12% of global sponsor-backed exits, more than double the average for the previous 3 years.2

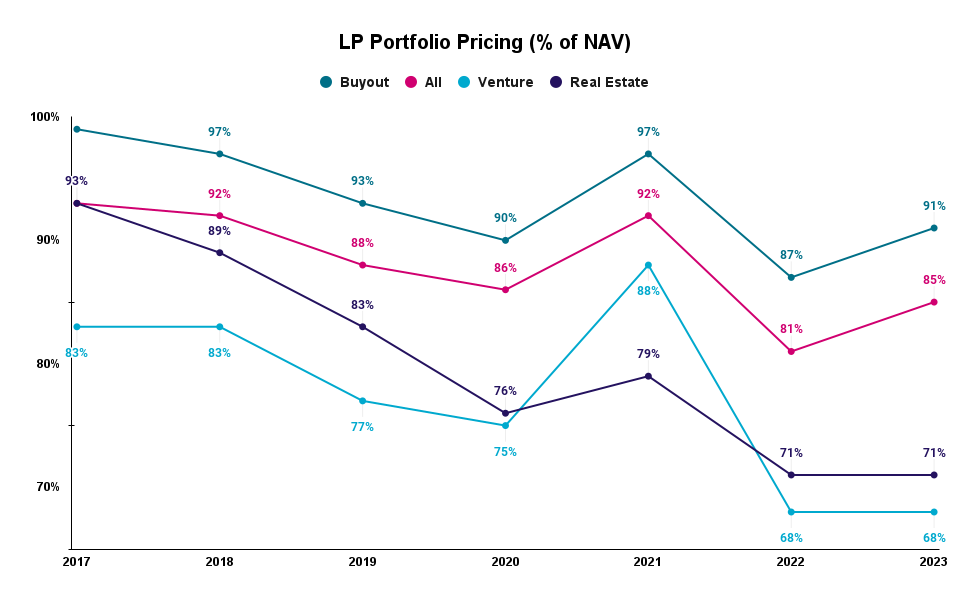

The thirst for liquidity has had a knock-on effect on pricing. Below, you’ll find a graph of annual pricing on LP deals across asset classes, where eagle-eyed readers will note that every asset class priced below its pre-COVID average in 2023. However, this was far from evenly distributed as buyout deals rebounded to 91% of NAV while venture pricing remained depressed at 68% of NAV. Part of this spread is due to differences in valuation policies, as buyout managers are often slower to write up portfolio companies than VCs, who typically write up portfolio companies every 1-3 years as they raise additional rounds of capital.4 Those external VC rounds are usually a strong anchoring point for venture valuations, which means that venture managers are slower to write down the value of their portfolios in a downturn.

Beyond technical pricing differences is a supply and demand mismatch. Jeffries pegs the dedicated capital available to pursue secondaries at an all-time high of $255B or 2.3x the market’s volume.2 Most of this dry powder has been raised to pursue buyout opportunities, including $23B for Lexington Partners’ latest fund5 and $25B for Blackstone’s most recent vintage.6 By contrast, the closed nature of many venture secondaries opportunities, smaller opportunity sets, and the higher bar on the diligence of rapidly changing venture-backed companies makes it more difficult to deploy capital at scale. This shows up in the fundraising figures, with the largest secondaries fundraises dedicated to venture Industry’s recent $1.7B vintage7 or StepStone’s $2.6B 2021 close.8

Finally, investors should consider how private secondaries compare with public markets. In the past year, the S&P 500 is up 28%, and the NASDAQ-100 is up 50%.9 Cambridge Associates’ most recent one-year buyout performance was pegged at 6.4%, while venture turned in a -10.4% return.10 So while private company valuations might have looked stretched relative to their public peers in 2023, the growth of public comps mainly fueled by multiple expansion makes the concern less salient in 2024.11

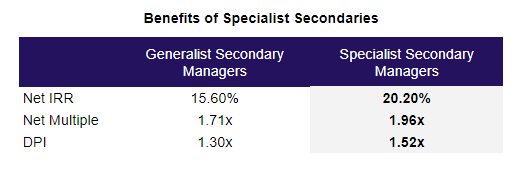

There is strong evidence that more niche secondaries managers engaging in less competitive bidding processes can produce outsized returns. Phil Huber at Cliffwater recently put out a note that segments the secondaries landscape into generalist firms with larger fund sizes and broader remits and specialist firms focusing on a narrower slice of the market.12 He found that Specialists outperformed by ~5% per year across a 250 fund dataset. This makes sense, as we would expect excess returns to be eroded in markets with more dry powder outstanding.

Bringing it all together, investors can benefit significantly from secondaries funds due to a faster payback period than primary investments, increased diversification, and competitive returns. Now is a particularly advantageous time to tap the secondaries markets with discounts to NAV above pre-COVID averages across asset classes and even further above average in more niche spaces like venture. Higher prices for public stocks make these entry points more valuable on a relative basis. When considering how to play the space, investors should consider the degree to which specialization gives a manager they are considering partnering with a relative advantage.

Hamilton Lane published a good note about building a robust private markets portfolio. It shares many of our views about why high-net-worth portfolios should move from 3% allocations to private markets to closer to an institutional ~25%, including diversification and a declining number of public companies for investors to choose from. More persuasive are the return benchmarks, which show global Private Equity easily outpacing world stock markets and Private Credit comfortably exceeding their closest analog, leveraged loans.

The note goes on to spell out the key factors that need to be managed when building a private markets portfolio, including:

We agree wholeheartedly, and that’s why Gridline has been transparent about not overpromising and underdelivering on liquidity, simplified call schedules for underlying investors, and assembled an investment team focused on sourcing the most compelling private market opportunities. Because that team gets to tap into Hamilton Lane’s Cobalt database, we get insight into many of the same opportunities Hamilton Lane focuses on. However, we would add two complexities investors have to manage that went under-discussed in the article.

The first is investment minimums, which can prove especially challenging to meet for those looking to access top-performing flagship funds rather than made-for-retail funds with different deals. The second is accessing performance and tax information, which can prove cumbersome for an industry that typically provides reporting updates via emailed PDF. We’ve worked hard to solve both problems with minimums ranging from $50K to $250K (due over several years) and consolidated tax and performance reporting.

If now is the time to reexamine your portfolio allocation, I’d be happy to walk through the opportunities available on the platform today.

-Charles Patton, Director, Investments

To view and download full details of the funds on our platform and in future emails like these, visit app.gridline.co/signup and answer a few quick questions that allow us to verify your identity and learn about your allocation strategy. There is no cost or commitment to create an account on Gridline.

Carta consolidated insights from their expansive dataset to enable informed decisions and illuminate market conditions. Read more.

Michael Sonnenfeldt, the founder of Tiger 21, appeared on CNBC last week to discuss “Where the Super Rich is Investing.” He speaks to insights from the global ultra-high-net-worth networking group’s latest Asset Allocation Report.

A few takeaways:

We see these trends reflected in the investment patterns of ultra-high-net-worth investors who leverage Gridline to build their own high-performing portfolios.

But it’s not just the super-rich.

Accredited investors, whether directly or via their investment advisors, are leveraging Gridline Thematic Funds to build portfolios that resemble those of more substantially capitalized investors.

– The Team at Gridline

In 1969, a team of researchers at UCLA sent the first message between two computers to Stanford on the Advanced Research Projects Agency Network (ARPANET). Often known as the forerunner of the internet, ARPANET was funded by the Department of Defense to link research institutions with government grants to speed technological development. It only took a few years for one of the academics, Bob Thomas, to create a program named Creeper that could track network activity and report back its findings. This was quickly followed by Ray Tomlinson’s Reaper antivirus software, which chased and deleted Creeper wherever it was found.

This tit-for-tat between Bob and Ray is the first example of cybersecurity in action, and for the past five decades, the battle between those looking to penetrate online networks and those erecting defenses has continued to escalate. In 2023, end-user spending in the market for information security from cyber attacks was projected to reach $188B, which would represent 11.3% growth from 2022. Estimates for how large this market can get vary widely, but a study by McKinsey pegged the top end at $2 trillion.

Why does such explosive growth appear likely? One way to approach that question is to consider how much cybercrime costs today and how that’s likely to change. The team at Cybersecurity Ventures estimated that cybercrime would cost $8 trillion in 2023 and $10 trillion by 2025 due to a host of costs, including data destruction, stolen money, IP theft, and reputational harm, among others. Another barometer includes surveys of top executives purchasing cyber defenses as they are the ones writing the checks. Morgan Stanley asked 100 Chief Information Officers in early 2023 about which programs would receive the largest spending increase, and Security Software came first.1 More revealingly, when asked which programs are most likely to be cut, none of the CIOs mentioned Security Software.

Not only is explosive growth possible, but there are reasons to believe startups will have an outsized role to play in defending against the next generation of attackers. One is that entrepreneurs can structure their firms to prevent today’s threats. Cyber professionals have already started to see Generative Artificial Intelligence (AI) contribute to cyber attacks by making it cheaper for groups to run spear phishing or automated customer support scams. The US government has noticed, setting up an AI Security Center within the National Security Agency (NSA) to guard sensitive information that can’t always be addressed with third-party software. Similarly, advances in quantum computing threaten to make many current encryption methods obsolete. Companies built to stop these new vectors of attack stand to benefit if they can outperform legacy players, and historically, incumbents have struggled to innovate on new products while staying at the cutting edge of their existing products. This is especially easy because experienced cyber operators can offer consulting services independently to generate revenue while developing the next software program to productize their insights.

Considering the size and growth of the cyber market, you might expect the venture industry to be rushing headlong into cyber. TechCrunch’s data disagrees, and they estimate Security startups only raised $2.7B in funding over the first quarter of 2023, down 58% year over year. Beyond a general funding malaise, VCs also might be reacting to the difficulties in investing in the space as a generalist. Cyber-specific VCs enjoy advantages on the sourcing side because their relationships with executives purchasing cyber solutions can help startups get a foot in the door with potentially huge clients. They are also advantaged with investment diligence because extensive experience allows them to more easily separate overhyped players from true security breakthroughs. This is crucially important in an industry where companies can grow revenue before the flaws in their security solutions manifest.

Cybersecurity is an industry ripe for continued growth and disruptive innovation. As investors consider how they want to position portfolios against potential disruptions from AI or quantum computing, it would be wise to consider how cybersecurity investments could function as an (imperfect) hedge. We are excited to see how the space develops in the years ahead and hope that those building protective walls outpace bad actors seeking to scale them.

Happy holidays! I’m Charles, taking over for Logan in this edition of our newsletter. We wanted to take this opportunity to review our 2023 predictions and grade our predictive performance. We think we did a pretty good job, given that 2023 was a volatile year for investing, but we’ll let you be the judge.

In January of last year, the writing was on the wall that banks were not going to be able to extend the type of credit that they did in the lower rate environment of 2020-2022. The collapse of Silicon Valley Bank, Signature, and other mid-sized banks accelerated this trend. This meant that every surviving bank smaller than the behemoths focused on shoring up their own balance sheets rather than lending more aggressively. The best data on this comes from PitchBook LCD, which tracks loans used to fund buyouts from private credit and the syndicated markets preferred by banks. Their Q3 update showed that the gap between buyouts financed by private credit and syndicated loans was at its widest point ever in 2023, and their figures likely understate the extent of the transition as they only track larger deals.

Take-private transactions in 2023 are even with 2022’s figures through 3 quarters by count and running a bit behind on dollars (numbers courtesy of PitchBook). That’s because deals in 2023 were slightly smaller than the past couple of years, a trend that accelerated in Q3 as 2/3rds of take privates were under $1B against a long-term average of 55%. Large take privates have not disappeared, though, evidenced by deals over $10B for Toshiba, Worldpay, and Qualtrics.

Sponsor acquisitions held steady in 2023 per PitchBook at 44% of exits, as corporate buyers continued to snap up PE-backed firms rapidly. Our rationale for sponsor-led acquisitions was sound, though, as the IPO markets remained largely closed, and only 1% of exits were to the public markets.

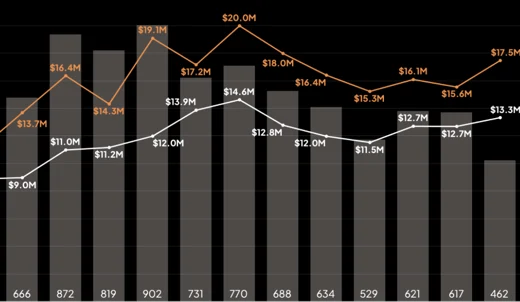

The best data source here is Carta, which publishes a quarterly report on venture trends using the proprietary data they have on over 41,000 venture-backed firms. The graph below shows the percentage of deals in a given quarter that included three common protection provisions: a liquidation preference, participation, and cumulative dividends. All three effectively allow venture capitalists to capture more of the value from a company’s exit if that exit is less than a home run. These terms either reached or neared cyclical highs in the first quarter of this year, a sign that venture investors were interested in protecting their downside. Founders were willing to accept them because they wanted to avoid a drop in headline valuations, though as the year wore on, more founders became willing to accept a lower valuation rather than load up the deal with protection provisions. The numbers below likely understate the extent of the shift, as the later-stage deals that more often include protection provisions were less common while early-stage deals held steady.

The headwinds definitely came for real assets in 2023 in the form of higher interest rates, which sent home sales tumbling to post-financial crisis era lows. This had a knock-on effect on private real assets fundraising, which followed a bumper year in 2022 with “the worst fundraising market in a decade.” The strategic opportunities in the space have indeed opened up, as areas like industrial outdoor storage and cell towers continue to see healthy demand.

In January, we will publish our quarterly outlook for Q1 2024. Until then, have a safe and happy holiday from everyone here at Gridline.

-Charles Patton, Investment Team

To view and download full details of the funds on our platform and in future emails like these, visit app.gridline.co/signup and answer a few quick questions that allow us to verify your identity and learn about your allocation strategy. There is no cost or commitment to create an account on Gridline.

Discover GP Stakes Investing: a unique blend of growth and stability for private market investors. Dive further into this innovative strategy with Gridline’s insights. Read more.

This past year, our engineering team rolled out dozens of innovations that improve private market investing.

These include features that provide greater portfolio transparency, like our Fund Activity View, as well as innovations that our investors don’t always see, like automated fund administration. Together, this allows us to create a world-class investor experience along with industry-low fees and minimums.

A perfect example of the streamlined investing experience we’ve created is that in 2023, on average, it took investors just 4 minutes to complete an investment from start to finish, including receiving funding instructions.

We look forward to continuing to deliver on our mission of delivering an unparalleled private market investing experience in 2024.

– Peter Bilali, VP Platform

It’s the most wonderful time of the year. Lights are going up around town, kids are eagerly anticipating a break from the scholastic grind, and savvy investors are considering how to position their portfolios for maximum after-tax gains in the years to come. One popular strategy that has traditionally paired well with the festive season is tax-loss harvesting.

Tax-loss harvesting begins with an investor considering their likely tax bill for the year and noticing a higher number than they would like to see, perhaps from selling a big stock winner or business. Rather than foot a hefty tax bill today, investors can sell an investment that has declined in value and use the realized loss to reduce their taxes. This not only eases the temporary burden, but Vanguard estimates that it can improve after-tax returns by above 1% annually, with the largest benefits accruing to the largest taxpayers with net worths above $1.2MM.

To understand why that might be the case, consider an investor, Bob, who makes a $100 investment in a stock that declines in value to $80 over a year (a 20% loss) and subsequently doubles in value to $160 (a 100% gain) before he needs to sell it to retire. Were he to hold that investment to retirement, he would take home $148 net of an assumed 20% capital gains tax rate. If, instead, Bob sells the investment at a 20% loss in the first year, he can use that loss to offset ordinary income or other short-term gains taxed at an assumed 30% tax rate, saving $6 in taxes ($20*30%). If he then reinvests the $80 of proceeds and the $6 tax savings back into a similar investment, that investment could grow to $172 ($86*2) by Bob’s retirement. Even after paying taxes on his gains, Bob walks away with $154.80, or $6.80 more than he would have had holding the investment all the way to maturity. $2 of that is from the lower assumed tax rate, and $4.80 is from Bob’s ability to compound capital for a longer stretch of time before paying any taxes.

There are a couple of simplifications to Bob’s example for investors to consider. First, the difference in Bob’s tax rates between year one and retirement was 10%, which assumed that Bob had short-term capital gains or standard income to offset short-term capital losses. Standard income can only be offset to a maximum of $3,000 annually, though some losses can be rolled. Investors should consult tax professionals to understand the specifics of their situation. Additionally, Bob’s savings rely on the underlying asset’s volatility. Repeating the same exercise with a year-one value of $90 and an exit value of $130 yields only $3.07 of savings. Finally, if Bob sells shares in a stock and purchases shares in the same stock, he will run afoul of IRS rules around “wash sales” and lose his ability to deduct losses from his taxes. Wash sale rules prohibit investors from buying securities that are the same or substantially identical within 30 days of selling below cost, so for Bob to operate within the rules, he would need to either wait for over a month to reinvest and risk prices moving away from him, or invest in a substantially different security with potentially different returns. Investors should consult legal counsel for more specifics.

What does tax-loss harvesting have to do with alternative investments? Alternatives are a great place to park the cash from tax-loss harvesting because of high historic returns, most of those returns coming in the form of long-term capital gains, and no issues with wash sales. Data provider Hamilton Lane looked at 10-year rolling returns from Private Equity and public markets side-by-side and found Private Equity outperformed all three public benchmarks in all but a handful of quarters since 2001. On the private equity side, most of those returns have come from long-term capital gains because investments are typically held for three or more years. They also do not trigger wash trading rules, as each fund has a different mix of portfolio companies.

Tax-loss harvesting comes with some complexities investors should review carefully, but has been shown to increase after-tax returns and free up liquidity. Investors evaluating the strategy should consult tax and legal advisors and carefully consider which investments to rebalance into that steer clear of wash trading rules and provide compelling returns. Alternatives have a role to play in many accredited portfolios and deserve a long look from properly qualified investors.

Ready to diversify your portfolio with alternatives? Join our network of investors, wealth advisors, and family offices to get access to top-tier fund managers across venture capital, private equity, private credit, and real assets. Gridline is free to join. Get access now to review all fund details instantly.

Resources to Learn More: