It was hard to miss the news over the last two weeks that Kim Kardashian is launching her own private equity firm, SKKY Partners, and is reportedly seeking to raise $1 billion. It is certainly not a novel concept for celebrities and cultural figures to try their hand at investing as they believe they can identify new companies and trends while generating publicity for their investments via social media and brand endorsements.

While there are many approaches to celebrity investing, one interesting component of Kardashian’s new venture is her partner, Jay Sammons, who previously ran the Carlyle Group’s global consumer, media and retail division. Partnering with a notable “traditional” institutional investor has proven to be an effective strategy for celebrity investing.

Marcy Venture Partners was launched when Jay-Z teamed up with Walden VC general partner Larry Marcus. Elevation Partners was formed with the combination of Bono, Roger McNamee from Silver Lake Partners, and Bret Pearlman from Blackstone. Steve Young launched HGGC with Greg Benson from Bain Capital and Rich Lawson from Huntsman Gay Capital. The list goes on, but these notable funds all have one common thread – leveraging top-tier institutional investors.

Rarely does the average investor have the ability to launch their own investment fund or work with such prominent allocators. We started Gridline to enable all investors to bring elite managers into their own portfolios, leveraging the investment discipline, operational excellence, and portfolio expertise of top-tier funds to generate outperformance for the rest of us.

Recent changes allow alternative investments to be held in an IRA, opening up a new world of investment opportunities for retirement savers. Read more.

While they are subject to the same interest rate dynamics as public markets, there are a few ways in which private markets may be less impacted. Read more.

As you may have heard, just over a year after raising at a $10 billion valuation, Figma is getting bought for twice that price by Adobe.

Michael Jackson (the venture capitalist) broke out the share price that investors initially paid to get into Figma:

Adobe is buying Figma for ~$40.20 per share.

Index Ventures, Greylock Partners and Kleiner Perkins all own percentage stakes in the double-digits and will each return over $1 billion. Even investors in the recent 2021 round will double their money.

While 2022 may be saturated with market volatility headlines, this deal is a good reminder that industries will continue to pursue innovation, creating tremendous potential for investors that allocate a portion of their portfolio to a diverse set of top-tier VC fund managers who invest early in a company’s value creating innovation cycles.

Let us know what you think – please don’t hesitate to reach out.

-The Team at Gridline

We’ve been hard at work continuing to bring value to Gridline members, and we’re excited to partner with Millennium Trust to provide the ability to invest their retirement accounts into Gridline’s Thematic Portfolios.

While there is no legal distinction between a “traditional IRA” and a “self-directed IRA,” most custodian platforms don’t allow investments in non-public securities. Through our partnership with Millennium Trust, Gridline members have the flexibility to invest their IRA in alternative assets designed to reduce volatility and increase returns.

Traditionally, two common concerns when investing in alternatives are that they have long lock-ups and high minimums, and being able to invest from a retirement account can help mitigate both – Here’s how:

It is more important than ever to diversify past the traditional 60/40 model on which target-date funds are built. Our members can now leverage a self-directed IRA to invest in alternative assets like top-performing institutional investors.

If you are interested in learning more, I’d love to chat. Feel free to reach out or book a time.

-Logan Henderson, Founder and CEO

The adage is true: when everyone panics, that’s usually the best time to buy. And that’s exactly what VCs are doing. Read more.

Smaller funds have several inherent advantages that make them more attractive investments, borne out in their returns. Read more.

Campden Wealth and SVB recently released their 2022 Family Office Report. Key takeaways:

Early in their maturity model, family offices begin investing through funds of funds, which pool access constrained funds to deliver instant diversification. The report notes that the average minimum investment in a VC fund of funds is $1 to $5 million.

An investment in a Gridline’s Portfolio fund allows investors to build a family office-style portfolio of top-performing access-constrained funds for $100k, a fraction of the typical minimum investment.

Let us know what you think – please don’t hesitate to reach out.

-The Team at Gridline

Did you know that most of the assets under management at endowments are invested via external investment managers? According to Cambridge Associates, among endowments greater than $3 billion, the median number of external managers was 136, investing across 270 different vehicles. At the opposite end of the spectrum, the median for endowments less than $200 million was 27 managers, investing across 36 different vehicles.

To build this type of portfolio yourself, it would require over $35 million in investments assuming a conservative $1 million minimum commitment.

Unlike the public markets, where investors can purchase an index fund to gain exposure to an asset class, there are no investable private market indexes for broadly-diversified exposure to the private alternative asset classes.

We’ve built our Private Alternative Portfolios to help individual investors achieve the same multi-asset, multi-manager, multi-vintage strategy that endowments have been leveraging for the past +30 years to drive outperformance.

Now, individuals are able to replicate portfolio construction of leading institutional investors, but with more accessible investment minimums, an institutional-level of selection and diligence, and most importantly, access to top-tier fund managers.

-Logan Henderson, Founder and CEO

Investors seeking superior returns should consider investing in smaller private equity funds. Read more.

Liquid alts are mutual funds or ETFs that provide diversification and downside protection through exposure to alternative investments. Read more.

Since 1996, the number of US public companies shrank from 7,300 to 4,800, while PE-backed private companies grew from 1,600 to 10,100.

Last week The Wall Street Journal reported smaller companies have made up the bulk of buyout targets even as multibillion-dollar deals captured headlines.

“Buyout firms owned more than 10,000 US companies as of June 30, up from fewer than 2,000 in 2000, according to PitchBook. Some 80% of those companies are valued at between $25 million and $1 billion, a percentage that remained consistent over the past 20 years even as the industry ballooned.”

With about a third of the S&P 500 index often consisting of just ten companies, buyout funds are increasingly becoming a more essential portfolio allocation to build broad diversified market exposure.

Let us know what you think – please don’t hesitate to reach out.

-The Team at Gridline

Many individual investors often look at public markets like they are the only game in town to make money and meet their financial goals.

But with lofty valuations of public companies and depressed bond yields, the traditional 60/40 stock-to-bond portfolio has been thrown to the wayside, so the next generation of investors needs to pivot away from their parents’ investing methods.

While they can still try to squeeze all the juice possible out of the market, the most sophisticated endowments and institutions are looking elsewhere.

Institutions understand that value is often created in the early stages of a company’s growth, before it is publicly traded.

As a result, institutional managers seek out and invest in private markets and alternative assets — like private equity, venture capital, real estate and more — where opportunities exist for better returns with lower volatility and without taking on excess risk.

For example, over the last 30 years, Yale University’s investments in non-traditional assets grew to greater than 70%, from less than 20%, by leveraging venture capital, private equity, hedge funds, etc.

This “endowment model,” created by the late Dr. David Swensen of Yale, started the shift of endowment portfolios into illiquid private investments, and is credited with generating $20 billion in excess returns for the university. (Swensen, a PhD, was an institutional investor, endowment fund manager and philanthropist. He was the chief investment officer at Yale from 1985 until his death in May 2021.)

Right now, institutional investors have more than 55% of their assets allocated to alternatives largely due to their return potential, diversifying power and lower volatility. Meanwhile, retail investor allocation remains in the low single digits, because of historical access constraints.

With this in mind, it’s important for these next-gen investors to think about how they can close that gap by increasing allocations to alternatives. In the past, investors had to network for opportunities and build the team and infrastructure to invest in private markets.

Today, new technology platforms make it simple for individual investors to invest directly in alternative assets.

There are plenty of recent examples of successful on-ramps offering accessibility to new asset classes such as cryptocurrency, art and early- and late-stage private companies. With easily accessible options to gain entry into alternatives, investors can now seek out a holistic allocation strategy to invest in private market assets beyond traditional sources.

To stave off the volatility of inflation, rising interest rates and geopolitical uncertainty, next-gen investors are increasingly allocating to alternatives, which represent a great long-term investment due to their low correlation with and lower volatility compared to public markets. An estimated 81% of investors expect their allocation to alternatives to increase by 2025.

However, investors need to know what to look for when evaluating their investments.

I believe active fund managers are critical. Fund managers are good stewards of capital because they actively manage the portfolio by being on the board, participating in strategy sessions, hiring strong teams and increasing value all the way through an eventual exit. They nurture the companies they invest in to encourage their success and capture “private market alpha,” or the outsized returns that often occur when exposed to breakthrough companies.

There are always risks to consider when investing in the private markets. Those include opaque market information, illiquidity with longer-term hold periods, high investment minimums and the large variance in performance between top and bottom managers in alternative asset classes.

New entrants into the alternative investing space should start with funds or fund-of-funds that are found through reliable sources, making smaller contributions to build up toward their target allocation. Diversifying investments across different funds, asset classes, geographies, sectors, stages and vintage years can also help mitigate risk.

The number of alternative investment strategies available is growing rapidly, with new offerings introduced all the time. There are now hundreds of strategies globally and this number will only increase as new products emerge due to advances in financial technology.

Investing in alternatives offers investors options beyond what’s available in public markets, which can be useful for tailoring risk/return profiles or meeting specific goals such as preserving capital during times of market volatility.

— By Logan Henderson, CEO and founder of Gridline

This article was originally published on CNBC.com on April 8, 2022.

In an interview with Forbes this week, I spoke with an analyst about recent trends in private market valuations and what that means for investors.

While markdowns tend to drive “Doom and Gloom” headlines, some valuation decreases are healthy. After nearly 15 years of unprecedented growth, the public and private markets were due for a reset. But, the fundamentals of value creation in the private markets remain the same, and the time horizon of PE and VC funds allows you to invest across short-term market fluctuations.

The best companies will continue appreciating over the next five to ten years, and the key to capturing those returns is to be invested with top-tier managers. While there will be opportunities from trusted friends or past colleagues, investors who can leverage an institutional level of sourcing, selection, and diligence will be the ultimate winners.

-Logan Henderson, Founder and CEO

Deals done during downturns can create large amounts of value. Read more.

Mezzanine financing allows companies to raise capital without giving up equity or incurring too much debt. Read more.

“When we were turning out big profits, I became somewhat delirious, and looking back at myself now, I am quite embarrassed and remorseful.”

– CEO Masayoshi Son on SoftBank’s record $23 billion quarterly loss.

What can we take away from this high-profile personal reflection?

Bigger is not always better, and VC does not scale effectively. Son’s 2017 $100 billion Vision Fund was the main driver of the record loss. VC is a game of “big swings.” Still, too much capital creates pressure to invest more dollars into each company, inevitably pushing the fund’s dollar-weighted capital into larger, later-stage rounds at higher pre-money valuations while leaving partners less time to source, diligence, and support companies in their portfolio.

Let us know what you think – please don’t hesitate to reach out.

-The Team at Gridline

Traditionally, investing in alternatives requires leveraging your network to discover opportunities, completing the same forms with every new investment, attempting to manage cash flows with zero visibility, sifting through PDFs and emails to track performance, and managing a portfolio in a spreadsheet.

Large institutional investors can quickly deal with these challenges due to their significant pools of capital and the ability to attract and afford the talent required to source opportunities, construct well-diversified private portfolios, and develop technology solutions that consolidate investment performance.

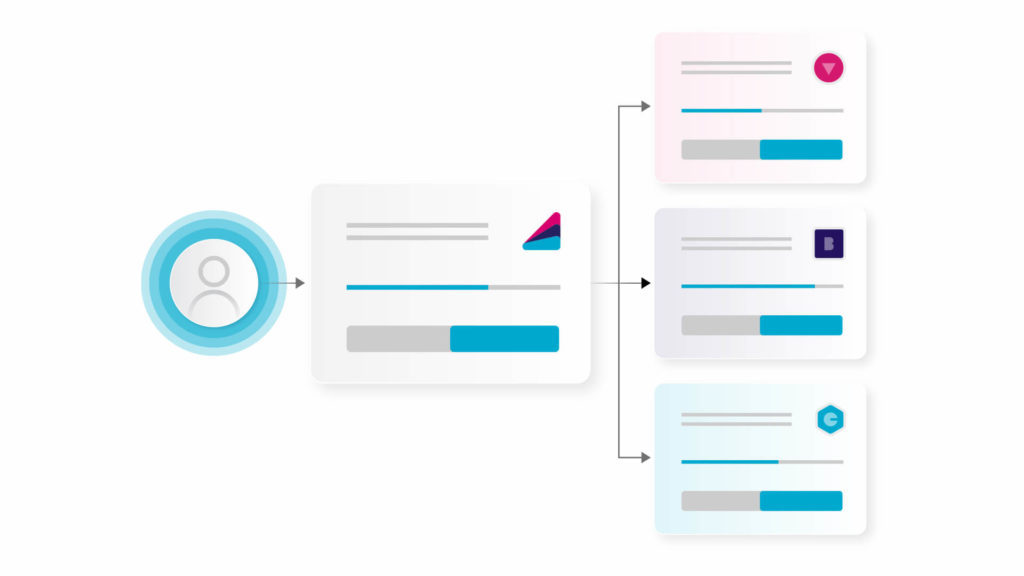

At Gridline, we have developed an innovative platform that overcomes the legacy challenges of investing in alternatives by digitizing the entire investment process, namely the highly antiquated discovery, subscription, reporting, and administration processes.

The power of the Gridline platform is that it levels the playing field between individual and institutional investors by providing the resources required to build a high-performing portfolio of alternatives.

We simplify the process – create unified investment profiles that enable you to invest through different entities, across products and asset classes, with just a few clicks. Leave the hard stuff to us, like manager due diligence, portfolio reporting and monitoring, taxes, and treasury management.

-Logan Henderson, Founder and CEO

If you’re looking for large-cap potential, the private markets are where you’ll increasingly find it. Read more.

Asset managers address perceived complexity and transparency in private market investing. Read more.

CalPERS, the largest defined-benefit public pension in the U.S., just announced a preliminary net investment return of negative 6.1% for the 2021-2022 fiscal year ending June 30. Unsurprisingly, depressed financial markets, geopolitical instability, interest rate hikes, and inflation have all impacted their returns.

However, a bright spot in the report is that while public equities delivered a negative 13% Net IRR, private equity returned a 21.3% Net IRR.

What’s their plan to help deliver strong returns? “Implement our new strategic asset allocation and increase our exposure to private market assets.”

While every investor has unique circumstances, CalPERS takes a long-term view to ensure positive outcomes for the more than 2 million benefit recipients and members.

Let us know what you think – please don’t hesitate to reach out.

-The Team at Gridline

What do the British Open and Foundry have in common? WHOOP.

WHOOP is both the “Official Fitness Wearable of the PGA TOUR” and a portfolio company of Foundry, having led a $55M Series D round in late 2019.

With the British Open starting today, some of the game’s most notable golfers, including Justin Thomas and Rory McIlroy, will be wearing a WHOOP device to monitor their performance, sleep, and recovery. Justin Thomas, who had a historic comeback victory at the PGA Championship this year, slept so soundly the night before Sunday’s final round that he recorded a 100% sleep score and an 89% recovery score. He was ready for that historic win.

Foundry’s investment in WHOOP is a perfect example of their playbook: Leverage the partner funds’ portfolios as a filtered opportunity set for direct investments, and invest in themes, which are long-term, horizontal views of trends in technology and innovation. Foundry was introduced to WHOOP by Founder Collective, a partner fund. The Company falls into the theme of Human-Computer Interaction, which believes that the computing world is ripe for a series of significant shifts in user-interface paradigms (how we interact with computers).

WHOOP is bringing a new level of data and intelligence to the fitness and health market, representing a massive winner for Foundry. In August last year, they completed a $200 million Series F round at a $3.6 billion valuation.

At Gridline, two of our “Four Ps of Manager Selection” are Process (managers whose success has been based on their investment skill and process, rather than luck) and Philosophy (long time horizon strategies, where fund managers are not distracted by short term noise) and this is an excellent example of both.

-Logan Henderson, Founder and CEO

Gridline’s due diligence process includes these four Ps to identify and diligence the best managers for our clients. Read more.

Gridline creates an efficient way for investors to gain diversified exposure to non-public assets with low capital minimums. Read more.

After years of rushed negotiations and minimal due diligence, firms spend more time vetting investments and, in some cases, walking away from deals.

Nearly unheard of a year ago, a robust diligence process is becoming more prevalent again and should ultimately lead to better outcomes as deeper evaluation can identify firms with management problems, potential issues with product market fit, or a lack of financial controls. Additionally, investors are taking advantage of the current market dislocation to secure better terms, including discounts and liquidation preferences.

While companies will face a more challenging market for fundraising than in previous years, this diligence process is healthy. It leads founders and executives to scrutinize their businesses and make better long-term decisions more closely.

There will undoubtedly be some painful experiences along the way. Still, this reset to a more traditional investment process will create a healthy, thriving private market ecosystem, reducing the internal burden of private market investment and administration.

Let us know what you think – please don’t hesitate to reach out.

-The Team at Gridline

The stock market downturn has created a compelling buying cycle for private equity firms, namely through the ability to take public companies private and acquire companies that were planning to go public. While some companies may not be receptive to these transactions in the near term, anticipating that their valuations will recover, we are starting to see how the current market dynamics will yield opportunities.

The time a company stays private has significantly increased, with listed software companies taking an average of 9 years before going public. Additionally, the rapid repricing of software valuations and a falling share price can lead to management choices today that run counter to perspectives a short time ago. The piles of private money (dry powder) waiting to be deployed is substantial. It creates an opportunity for investors to realize some of their returns, albeit at a steep discount to what they may have gotten during the last two years.

The winner in this cycle will be private equity firms and their investors, which can capitalize on the opportunity to buy companies with a solid long-term trajectory that a market dislocation has hampered.

-Logan Henderson, Founder and CEO

A fund of funds is an investment vehicle that gives investors access to a diversified portfolio of private equity funds. Read more.

One option is to invest more heavily in alternatives, such as private equity and venture capital. Read more.

In their recently published 2022 Global Family Office Report, UBS found that:

Gridline sources institutional-level opportunities and performs methodical due diligence to enable investors and family offices alike to create outsized private equity returns while reducing the internal burden of private market investment and administration.

Let us know what you think – please don’t hesitate to reach out.

-The Team at Gridline

One term you may have heard mentioned recently is the “denominator effect” and its impact on private markets.

As a quick primer, nearly every institutional LP operates within a target allocation framework for various asset classes (e.g., 20% to private equity, 20% to real assets, 40% to public equity, and 20% to fixed income). When the stock market declines dramatically, the public market investments fall in value immediately, while the private market investment values will not be impacted for several months (if not years).

This leads to the total portfolio (the denominator of the equation) decreasing and the private market investments of the portfolio being a more significant portion of the total, leading to rebalancing where they are over-allocated. This emerging dynamic among institutional LPs creates two positive impacts for individuals:

The full impact of these dynamics may take some time to be realized, but the long-term outlook for those entering the market now is positive.

-Logan Henderson, Founder and CEO

As Warren Buffett puts it, “I don’t think most people are in a position to pick single stocks.” Read more.

Index funds provide instant diversification and can help to reduce the overall risk of your investment portfolio. Read more.

According to Goldman Sachs, a seismic shift is occurring in the private market investor base, from 5% to 8% of the $10 trillion market today to 20% to 30% of new capital coming from individual investors over the next few years.

An efficient global distribution model is needed to enable this shift and create a new synergy between investors and allocators.

Our approach is to provide a curated selection of private market funds with lower capital minimums and fees, enabling individuals to realize the returns historically reserved for institutional investors.

Let us know what you think – please don’t hesitate to reach out.

-The Team at Gridline

We often speak about working with fund managers that are good stewards of others’ capital and help steward their investments’ success well into the future.

As you have certainly read, after more than two decades as a leader in Silicon Valley, Sheryl Sandberg announced she planned to depart this fall as Meta/Facebook COO. Alongside Mark Zuckerberg, she built a behemoth of a business out of Facebook and grew revenue from $272 million in 2008 to nearly $118 billion in 2021.

Sandberg oversaw hundreds of initiatives that would create the modern advertising ecosystem, and her focus on scale and measurable outcomes led to significant commercial success and investment returns.

While not a fund manager, Sandberg was a great steward of capital and guided the business through massive growth, periods of instability, and ultimately on the path to becoming a once-in-a-generation company. Zuckerberg summarized her impact better than anyone else: “Sheryl architected our ads business, hired great people, forged our management culture, and taught me how to run a company.”

Gridline’s focus is building relationships with managers that have unique analytical talent, anticipate market movements, exhibit portfolio management skills, and have the deep conviction to outperform on a long-term basis in ways others can’t match. Sheryl Sandberg embodied these characteristics more than most in today’s business world.

-Logan Henderson, Founder and CEO

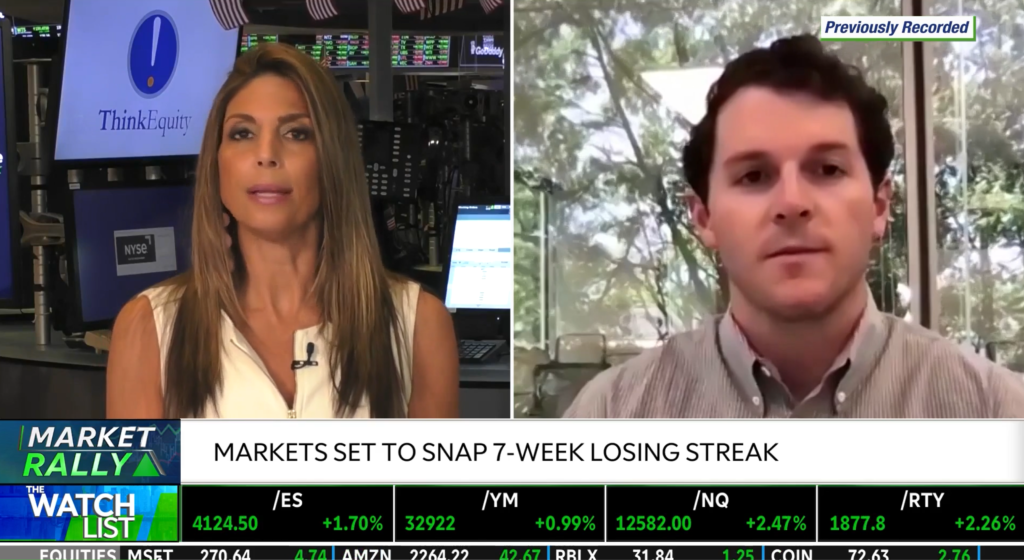

While financial market headlines are overwhelmingly bleak, downturns rationalize the private markets, and innovation continues. Check out Logan on The Watch List.

With the right approach, private market investing can be just as simple and safe as investing in public markets. Read more.

Phil Herget and the team at Ardent Venture Partners reflect on investing through two decades of boom and bust that included the Dot-Com collapse of 2001 and the financial crisis of 2008:

{For a Smart, Experienced Investor,} Recessions Aren’t Always Doom and Gloom.

We share their optimism:

Let us know what you think – please don’t hesitate to reach out.

-The Team at Gridline