Private credit, or direct lending, is a rapidly growing asset class that offers investors attractive yields and downside protection. As banks pull back from traditional lending, there’s a growing demand for a wide variety of private credit strategies, from middle-market lending to specialty finance and asset-backed lending.

Analysts forecast turbulent market conditions, with higher inflation and lower returns for traditional fixed-income assets. As such, most investors seek to increase their allocation to private credit. This asset class can help investors better manage risk and enhance returns over the long run.

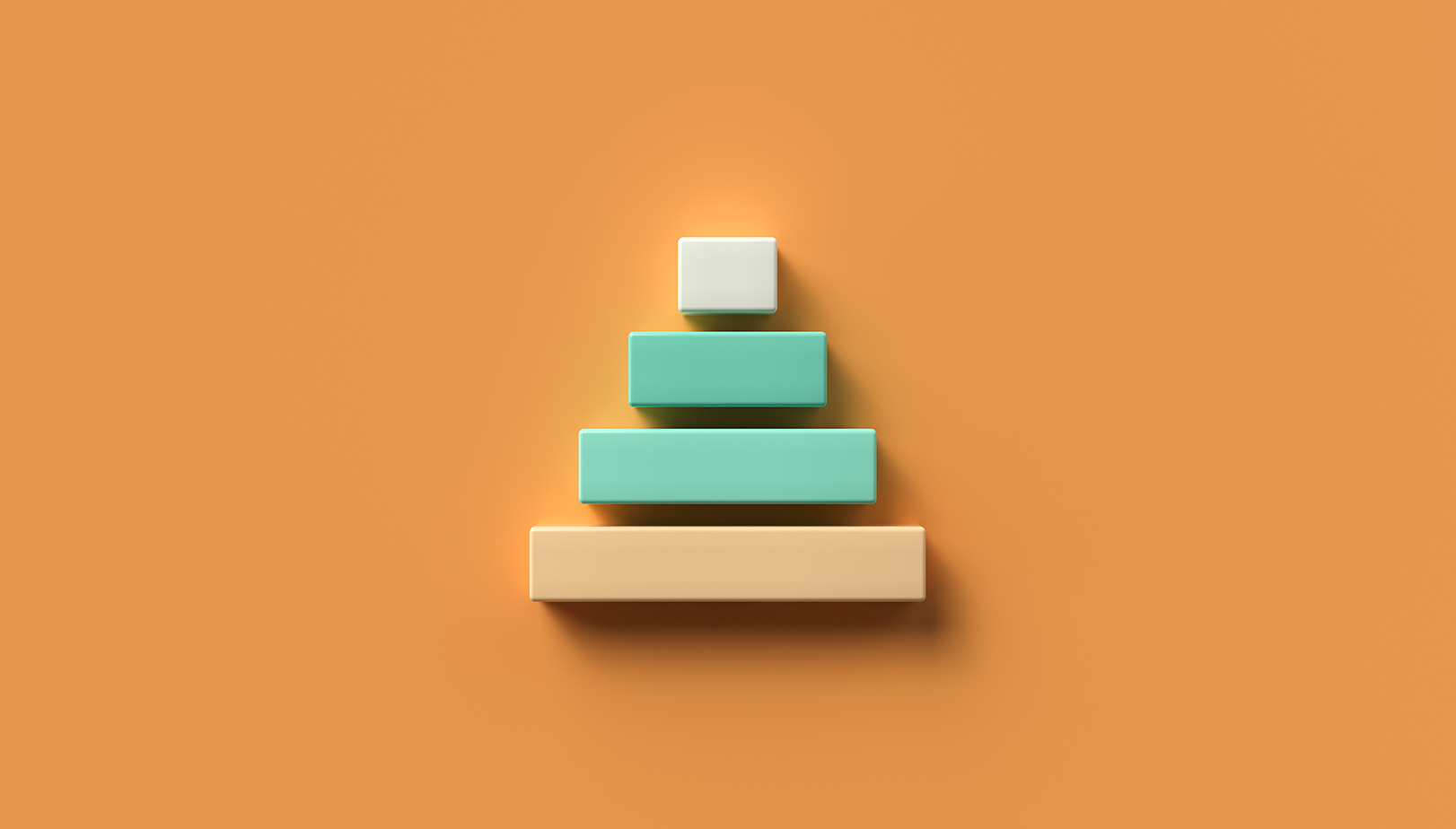

To better assess the potential opportunities, it is vital to understand how the capital structure works and how investments in private credit are positioned. The capital structure, also known as the capital stack, is the hierarchy of debts and equities in a company’s balance sheet and determines the order of payments in the event of bankruptcy.

The order of the capital stack

The capital stack, oriented from top to bottom, comprises senior debt, unitranche debt, subordinated debt, mezzanine debt, and equity. The top of the stack is the least risky, being repaid first in the event of bankruptcy. Equity is the riskiest at the bottom of the stack since it is repaid last.

Senior debt

In 2021, almost half of all capital raised by private debt funds went to senior debt. In an uncertain macroeconomic environment, investors want to access the attractive diversification and return potential offered by private credit but with low risk. Senior debt is the lowest-risk form of debt capital, so it has become the most sought-after.

This is because senior debt is typically secured by collateral or assets over which the lender has a ‘first lien’ (first claim). It has priority over more junior debt within the capital structure and typically carries a lower interest rate than more junior or subordinated debt.

Before the 2008 financial crisis, the private debt industry focused on subordinated and distressed debt. However, a mountain of new regulations imposed on banks, such as Basel III, have caused banks to become more conservative and less willing to provide senior debt. This has opened up opportunities for private debt investors to provide senior debt capital to companies, providing both security and returns.

Private debt investors are now companies’ primary source of senior debt capital. This has particularly benefited small and medium-sized enterprises (SMEs) that may not have easy access to bank financing. Private debt funds can offer senior debt capital to SMEs and other companies at competitive rates and with flexible terms.

As private debt investors become increasingly confident in their ability to assess creditworthiness and structure debt deals, more senior debt capital will be available and more companies will be able to access the capital they need to grow and develop.

Unitranche debt

However, the demand for private debt goes beyond senior debt, and debt investors are increasingly diversifying across strategies. Unitranche debt, for instance, is a combination of senior and subordinated debt issued by one debt provider, usually used to facilitate a leveraged buyout.

It can help buyers simplify the debt structure, as one lender can satisfy the whole debt requirement. Since it contains senior and subordinated debt elements, the interest rate charged is often somewhere between the two.

Unitranche debt is becoming increasingly popular with buyers and lenders, allowing borrowers to access capital with a more simplified and efficient structure.

For lenders, unitranche debt provides an opportunity to increase their exposure to a transaction by taking on more risk than they would typically accept via a senior debt facility. Lenders also benefit from the fact that they can negotiate terms closer to those of a subordinated loan while still having the more senior debt element in the structure.

For investors, unitranche debt has its advantages. Since it combines senior and subordinated debt, the risk is balanced, protecting investors against default. Returns are also moderately attractive, as the interest rate is higher than that of senior debt but lower than that of subordinated debt.

Subordinated debt

Subordinated debt, also known as “junior debt,” is a loan further down the capital stack. This more risky debt typically attracts a higher interest rate than senior debt. It is often used when the borrower cannot access sufficient senior debt.

Subordinated debt is prevalent among smaller, more entrepreneurial companies that require additional capital to fund growth or acquisitions. Because of the higher risk associated with subordinated debt, lenders may require that the borrower have a track record of profitability and stability and a well-established business plan.

The primary benefit of subordinated debt is that it carries a lower cost of capital than equity, making it an attractive source of financing for growth-oriented companies.

The most significant risk is that the subordinated debt will be wiped out in the event of bankruptcy, meaning that the lender will not receive any return on their investment. Additionally, subordinated debt is typically unsecured, meaning that lenders do not have a claim on any of the borrower’s assets in the event of bankruptcy.

Mezzanine debt

Mezzanine, which means “in the middle,” is another form of capital that sits between senior debt and equity. It is typically used as a solution-oriented capital, meaning that the business owner is looking for an infusion of cash to solve a specific problem.

It is attractive to businesses and lenders because it carries a higher interest rate than senior debt and is often structured with warrants, giving the lender the option to convert the debt to equity if the company defaults.

Borrowers typically turn to mezzanine lenders when cheaper forms of senior secured lending are unavailable to them, whether because their existing senior debt load is considered high or because their business model is considered too risky for conventional lenders. This means that risk and potential reward are both higher for Limited Partners (LPs) considering an investment in a mezzanine fund than a direct lending one.

Despite the economic uncertainty, the outlook for mezzanine financing is vital. Indeed, this market volatility is causing some senior lenders to withdraw from the market, making mezzanine financing an attractive option for companies needing capital.

Equity

At the bottom of the capital structure is equity, the residual interest in a company’s assets after all debts have been paid. This is the riskiest form of capital since it is repaid last in the event of bankruptcy.

The appeal of equity capital is that, unlike debt, it does not require repayment and provides a stake to the investor in the company. Equity investors typically look to the long term and seek a return based on the potential appreciation of the company’s stock.

A thorough understanding of the capital structure is essential for anyone looking to access private credit market opportunities. Not only does it provide added insight into the risks and rewards associated with private debt investments, but it can also be used as a way to manage risk better and enhance returns.