When IBM chairman Thomas Watson was selected to serve as ambassador to the USSR in 1979, he had a problem. Ethics norms of the time dictated he needed to dispose of his personal stakes in several VC funds he’d accumulated over years of investing in the early computing industry. Watson tapped Dayton Carr to help market the fund interests. After significant effort, Carr was able to find willing buyers in the nascent private markets ecosystem to complete the sales. This convinced Carr to set up the world’s first dedicated secondaries firm, Venture Capital Fund of America, to pursue the strategy full-time.1 Carr ended up nurturing several industry luminaries, including Jeremy Coller (CEO of Coller Capital) and Andrew Isnard (CEO of Arcis Group).

Today, the industry Carr helped birth transacted $112B of volume in 2023 and has spread into every private asset class.2 Whether because of competitive returns, diversification, or quicker cash conversion cycles, secondaries have become an increasingly important arrow in the quiver of private market allocations available to investors. This article will walk through two common types of secondaries deals, recent trends in different corners of the market, and things for investors to keep in mind before jumping in.

Types of Secondary Deals

LP Stake Sales

Watson’s quandary is an example of the original form of secondaries transactions, LP stake sales. These involve Limited Partners (LPs) looking to sell private fund interests and secondaries managers hoping to acquire them for less than their intrinsic value. LPs might be looking to sell because of shifting strategic mandates, idiosyncratic personal factors, loss of conviction in a manager’s strategy, or to free up liquidity. Buyers are tempted by typical discounts to Net Asset Value (NAV) at purchase, a shorter runway to liquidity as typical sales take place in the latter years of a fund’s life, and a mostly known and well-diversified portfolio.

Strategic Considerations

Many private fund contracts require General Partner (GP) consent before interests are transferred, which means the GP must approve LP stake purchasers before any sale. This is especially true for Venture managers, who can be sensitive about allowing new investors into the partnership who might publicize portfolio company information. These dynamics help existing LPs in a fund get a leg up when purchasing stakes, as they can be trusted not to circulate information and are knowledgeable enough about the portfolios to ascertain their true value. Because that pool of LPs is often smaller than buyout funds, bidding for venture portfolios tends to be less competitive.

GP Continuation Vehicles

As secondary markets developed, a pattern of LPs looking to unload interests in long-dated funds emerged. Because fund interests might be a bit small by that stage of a fund’s life, LPs might not get great asset pricing. GPs became aware of this dynamic and introduced continuation funds, where LPs would be given the option to sell their interests in one large block and hopefully fetch a better price. GPs are quite enthusiastic about the prospect as it allows them to reap significant carry when LPs extinguish their fund interests and restart the clock on fee income (which GPs receive from new purchasers in exchange for continued management of the assets). Less cynically, they can also allow GPs to pursue more long-term value enhancement plans rather than forcing assets to market prematurely.

Strategic Considerations

From a purchaser’s perspective, continuation vehicles offer the chance to purchase significant exposure to a concentrated portfolio. Because managers typically run a bidding process for the right to participate, secondaries purchasers can get an opportunity to learn more about the assets they’re purchasing, particularly if they are less familiar with the manager. In the words of one market participant, “Managers can sell these assets to any number of people.”3 This same broadly marketed process usually means more competitive pricing, requiring purchasers to be spot on when forecasting portfolio company growth.

Why Now?

Whether on the LP or GP side, this market environment has been conducive to significant secondaries volume. Jefferies estimates that 2023 was secondaries’ second-largest year behind 2021, with volume fairly evenly split between GP continuation vehicles and LP stake sales.2 LP volume was dominated by Pensions and Sovereign Wealth Funds, which is perhaps unsurprising as they are the largest individual pools of capital. On the GP side, higher rates made the traditional exit routes of IPOs, M&A, and dividend recaps scarce, creating a strong opportunity for continuation funds to provide liquidity. Continuation funds reached an all-time high of 12% of global sponsor-backed exits, more than double the average for the previous 3 years.2

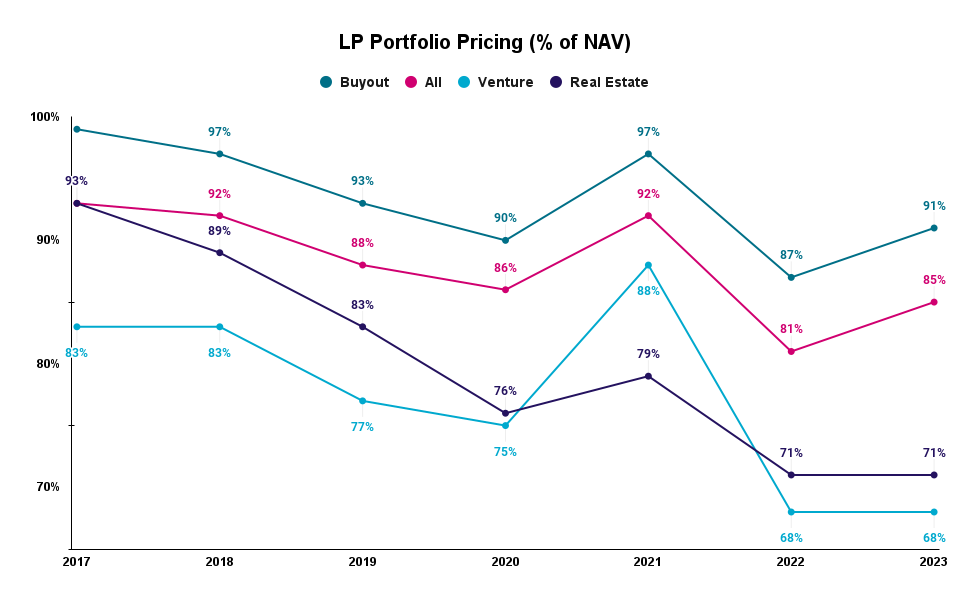

The thirst for liquidity has had a knock-on effect on pricing. Below, you’ll find a graph of annual pricing on LP deals across asset classes, where eagle-eyed readers will note that every asset class priced below its pre-COVID average in 2023. However, this was far from evenly distributed as buyout deals rebounded to 91% of NAV while venture pricing remained depressed at 68% of NAV. Part of this spread is due to differences in valuation policies, as buyout managers are often slower to write up portfolio companies than VCs, who typically write up portfolio companies every 1-3 years as they raise additional rounds of capital.4 Those external VC rounds are usually a strong anchoring point for venture valuations, which means that venture managers are slower to write down the value of their portfolios in a downturn.

Beyond technical pricing differences is a supply and demand mismatch. Jeffries pegs the dedicated capital available to pursue secondaries at an all-time high of $255B or 2.3x the market’s volume.2 Most of this dry powder has been raised to pursue buyout opportunities, including $23B for Lexington Partners’ latest fund5 and $25B for Blackstone’s most recent vintage.6 By contrast, the closed nature of many venture secondaries opportunities, smaller opportunity sets, and the higher bar on the diligence of rapidly changing venture-backed companies makes it more difficult to deploy capital at scale. This shows up in the fundraising figures, with the largest secondaries fundraises dedicated to venture Industry’s recent $1.7B vintage7 or StepStone’s $2.6B 2021 close.8

Finally, investors should consider how private secondaries compare with public markets. In the past year, the S&P 500 is up 28%, and the NASDAQ-100 is up 50%.9 Cambridge Associates’ most recent one-year buyout performance was pegged at 6.4%, while venture turned in a -10.4% return.10 So while private company valuations might have looked stretched relative to their public peers in 2023, the growth of public comps mainly fueled by multiple expansion makes the concern less salient in 2024.11

So What?

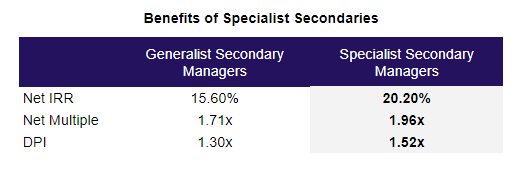

There is strong evidence that more niche secondaries managers engaging in less competitive bidding processes can produce outsized returns. Phil Huber at Cliffwater recently put out a note that segments the secondaries landscape into generalist firms with larger fund sizes and broader remits and specialist firms focusing on a narrower slice of the market.12 He found that Specialists outperformed by ~5% per year across a 250 fund dataset. This makes sense, as we would expect excess returns to be eroded in markets with more dry powder outstanding.

Bringing it all together, investors can benefit significantly from secondaries funds due to a faster payback period than primary investments, increased diversification, and competitive returns. Now is a particularly advantageous time to tap the secondaries markets with discounts to NAV above pre-COVID averages across asset classes and even further above average in more niche spaces like venture. Higher prices for public stocks make these entry points more valuable on a relative basis. When considering how to play the space, investors should consider the degree to which specialization gives a manager they are considering partnering with a relative advantage.

- Secondaries Investor, The Man Who Spawned a $88B Industry ↩︎

- Jefferies Global Secondary Market Review, January 2024 ↩︎

- Wall Street Journal, Sequoia Heritage Backs Private Equity Firm with Taste for Complexity ↩︎

- Goldman Sachs Asset Management, Unpacking Private Equity Valuations and Returns ↩︎

- Lexington Partners Press Release ↩︎

- Blackstone Press Release ↩︎

- Industry Ventures Press Release ↩︎

- Stepstone Investor Deck, page 37 ↩︎

- Figures from the Wall Street Journal as of 2/29/23 close ↩︎

- Cambridge Associates LLC US Venture Capital Index & US Private Equity Index as of 9/30/2023 accessed February 29, 2023 ↩︎

- Multpl pegs S&P 500 PE at 27.66 as of February 2024 and 22.66 as of February 2023, access after 2/29/2023 close. That is 22% annual growth, and rolling one-year earnings per share are slightly down by comparison. ↩︎

- Private Equity’s Second(ary) Act, written by Phil Huber for Cliffwater on February 21, 2024 ↩︎