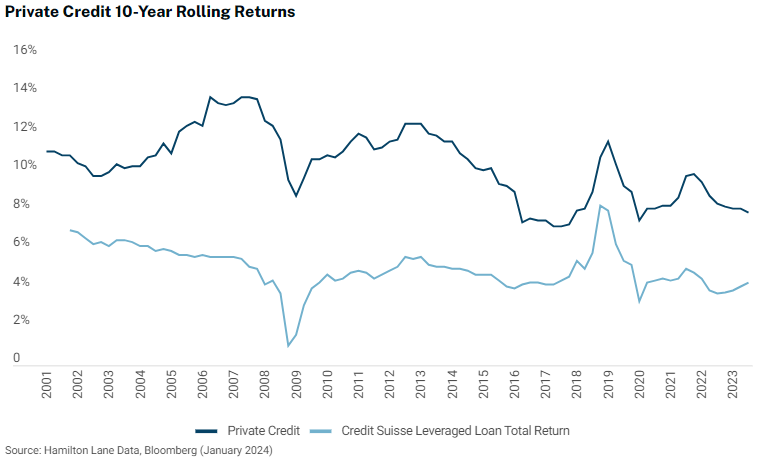

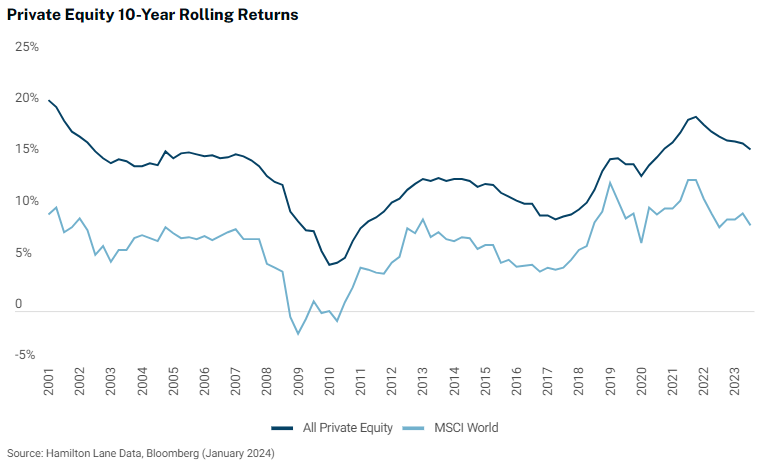

Hamilton Lane published a good note about building a robust private markets portfolio. It shares many of our views about why high-net-worth portfolios should move from 3% allocations to private markets to closer to an institutional ~25%, including diversification and a declining number of public companies for investors to choose from. More persuasive are the return benchmarks, which show global Private Equity easily outpacing world stock markets and Private Credit comfortably exceeding their closest analog, leveraged loans.

The note goes on to spell out the key factors that need to be managed when building a private markets portfolio, including:

- The illiquidity of the underlying assets

- The uncertainty around building exposure in an asset class that typically draws down funds over a ~5-year investment period

- Sourcing strong investment opportunities

We agree wholeheartedly, and that’s why Gridline has been transparent about not overpromising and underdelivering on liquidity, simplified call schedules for underlying investors, and assembled an investment team focused on sourcing the most compelling private market opportunities. Because that team gets to tap into Hamilton Lane’s Cobalt database, we get insight into many of the same opportunities Hamilton Lane focuses on. However, we would add two complexities investors have to manage that went under-discussed in the article.

The first is investment minimums, which can prove especially challenging to meet for those looking to access top-performing flagship funds rather than made-for-retail funds with different deals. The second is accessing performance and tax information, which can prove cumbersome for an industry that typically provides reporting updates via emailed PDF. We’ve worked hard to solve both problems with minimums ranging from $50K to $250K (due over several years) and consolidated tax and performance reporting.

If now is the time to reexamine your portfolio allocation, I’d be happy to walk through the opportunities available on the platform today.

-Charles Patton, Director, Investments

Featured Investments

To view and download full details of the funds on our platform and in future emails like these, visit app.gridline.co/signup and answer a few quick questions that allow us to verify your identity and learn about your allocation strategy. There is no cost or commitment to create an account on Gridline.

Worth a Read

Carta’s State of Private Markets: Q4 and 2023 in Review

Carta consolidated insights from their expansive dataset to enable informed decisions and illuminate market conditions. Read more.

Worth Watching

Michael Sonnenfeldt, the founder of Tiger 21, appeared on CNBC last week to discuss “Where the Super Rich is Investing.” He speaks to insights from the global ultra-high-net-worth networking group’s latest Asset Allocation Report.

A few takeaways:

- Entrepreneurs create wealth earlier in their lives, providing more runway to build wealth over multiple cycles.

- Private equity is now king, with their member’s average allocation to PE at 30%, compared to 25% in real estate and 20% in public equities.

- They’ve seen marked decreases in public equity and hedge fund allocations but a significant increase in venture capital investing, given its long-term potential to create value.

We see these trends reflected in the investment patterns of ultra-high-net-worth investors who leverage Gridline to build their own high-performing portfolios.

But it’s not just the super-rich.

Accredited investors, whether directly or via their investment advisors, are leveraging Gridline Thematic Funds to build portfolios that resemble those of more substantially capitalized investors.

– The Team at Gridline