In the aftermath of the Silicon Valley Bank (“SVB”) collapse this week, there are numerous factors that you can point to – Fed policy and rising rates, a classic “run on the bank” scenario, poor management of liabilities and investments on its balance sheet, accounting policy on “held-to-maturity” assets, a lack of interest rate hedging, a failed capital raise – which led to the demise of the bank.

Taking all external factors out of the equation and looking at the situation from a fundamental perspective, there are a few notable conclusions that you can draw which relate to broader investment strategy and portfolio management:

Lack of Diversification

SVB saw no risk in its highly concentrated base of technology businesses and did not try to diversify beyond that base, continuing to add more products oriented towards technology businesses, their employees and investors.

Lack of Financial Management

Poor corporate treasury management was the downfall of SVB and nearly the downfall for thousands of businesses that were customers of SVB. Thankfully, the US Treasury, Federal Reserve, and FDIC stepped in to guarantee SVB depositors for all money held at the bank.

Lack of Specialization

SVB is unique in that it was part depository institution, part venture lender, part venture investor, and part network. While all of these functions are helped by being ingrained in the technology industry, it is very difficult to be good at everything.

While the outcome and impact of SVB will continue to playout over the next few weeks and months, there is one simple takeaway: By spreading investments across different asset classes and sectors, investors can reduce their exposure to any one particular category and minimize their risk of a single failure causing a domino effect within the portfolio.

-Logan Henderson, Founder and CEO

Time horizons are an important consideration for venture funds and investors. Read more.

As investors of all types become increasingly aware of alternative investments, portfolio allocation to private markets will continue to grow. Read more.

This month, join us live for an interactive session featuring Gridline Founder and CEO, Logan Henderson, in conversation with Salil Deshpande, General Partner of Uncorrelated Ventures on Thursday, March 30th at 1:30 pm EDT / 10:30 am PDT.

This webinar is open to Gridline Members. If you would like to join us, please complete the process to sign up for access to Gridline and if you would like to join us we will send you your personal link to join the live webinar.

Preqin just published its “Investor Outlook: Alternative Assets, H1 2023”, with some notable findings from the comprehensive investor survey:

Let us know what you think – please don’t hesitate to reach out.

-The Team at Gridline

At $52 billion, The University of Texas Investment Management Company (UTIMCO) is the second largest endowment in the U.S. by AUM. Their FY 2022 Annual Report, reflecting performance from September 2021 through August 2022, shows a well-managed portfolio grappling with slowing economic growth, geopolitical turbulence, and the fastest tightening of US monetary policy in the last 40 years.

Important takeaways:

The fundamental strategies UTIMCO and other large institutions apply to drive long-term outsized returns can and should be applied to certain individuals’ portfolios.

Our Private Alternative Portfolios are constructed to replicate these institutional portfolio strategies, and their accessible minimums make it possible for individual investors to drive long-term, resilient outperformance in their own portfolios.

-Logan Henderson, Founder and CEO

Gridline’s Austin Guest shares his experience as a former independent advisor and the correlations he sees between public and private market investment strategies. Read more.

Though every asset class has cooled, recent data shows that VC activity is rebounding. The current market conditions present an opportunity for those with a long-term horizon. Read more.

Join Gridline Investment Team Senior Advisor, Doug Dougherty, on Thursday, February 23rd at 11 am EST for our February Member webinar.

In Navigating Alternatives we’ll be be giving an overview of alternative investing including:

This webinar is open to Gridline Members. If you would like to join us, please complete the process to sign up for access and we will send you your personal link to join the live webinar.

It’s easy to look at public markets and private markets as two different worlds. But the truth is, they’re not all that different. The core approach to investing in either market is pretty similar: You want to maximize diversification across companies and strategies, minimize fees relative to the asset class, and partner with firms who execute their strategies effectively.

If you can do that, you’ll have the best risk-adjusted long-term outcomes.

When John Bogle, the founder of Vanguard, launched the Vanguard 500 Index Fund in 1976, he showed that offering investors a better product at a lower cost was possible. And in doing so, he helped make investing more accessible for everyone by focusing on a few key elements:

Gridline is following in Vanguard’s footsteps. Like Vanguard, we are focused on offering a better product at a lower cost, and while the platform streamlines the process for discovering, deploying and managing a portfolio, what is more important is enabling investors to build a well-diversified portfolio of top-tier funds and expand their efficient frontier.

By offering our services at a fraction of the cost of competing offerings and using industry-leading technology to provide transparency, accountability and efficiency, we’ve been able to engage with investors at all levels – from new entrants to sophisticated institutions – and provide them with access to some of the most promising opportunities across the alternatives landscape.

-Logan Henderson, Founder and CEO

Rising inflation and interest rate hikes have squashed investor appetite for high-risk IPO candidates. Private market exits, however, are expected to pick up the slack. Read more.

A healthy majority of executives expect performance at their companies to increase year-over-year in 2023. Although a recession in 2023 is likely, private companies are feeling bullish about their prospects. Read more.

Join Gridline Investment Team Senior Advisor, Doug Dougherty, on Thursday, February 23rd at 11 am EST for our February Member webinar.

In Navigating Alternatives we’ll be be giving an overview of alternative investing including:

This webinar is open to Gridline Members. If you would like to join us, please complete the process to sign up for access and we will send you your personal link to join the live webinar.

The hype cycle, a framework developed by Gartner, defines the model for how technologies develop over time. It describes how an idea starts as just a spark of interest among a few people, then grows into a full-fledged industry with entrepreneurs rushing to commercialize the technology. We’re experiencing this cycle with “Generative AI,” which has popped up everywhere, given the popularity of ChatGPT, Lensa, and DALL-E.

The first stage of the hype cycle is the “innovation trigger,” when a new technology is discovered, before moving into the “peak of inflated expectations,” where investors start pumping money into the sector to the point that it becomes wildly overvalued. The third stage, the “trough of disillusionment,” is where people lose patience with a technology that fails to develop and realize that their investment expectations are unrealistic.

This same concept applies to companies. It’s essential for investors to be aware of the hype cycle and to understand the stage a company is currently in when they’re considering investing.

According to Forge Global, a secondary share trading platform, the bid-ask spread in the secondary market has increased to 22%. During November of last year, Forge Capital and EquityZen observed trades occurring roughly 45% below peak valuations. While sellers expect previous valuations, buyers are unwilling to match, and the spread is exacerbated by companies simultaneously lowering valuations.

In summary, buy when no one is talking about a company and sell once everyone is. Most money rushes in near the top and then suffers a loss. The few who can invest at the beginning will capture serious gains.

The best opportunity to capture these gains is by investing with professional fund managers that possess sector-specific expertise, which helps them identify and access emerging companies that will have a considerable impact and define a category.

-Logan Henderson, Founder and CEO

Investors must look for creative ways to diversify their portfolios and build resilience in economic downturns. Private markets offer a compelling solution. Read more.

On the surface, private equity and venture capital are similar. However, the two concepts are quite different. Read more.

In our first member webinar of 2023, we’ll discuss how you can enhance your investing strategy by moving beyond the public markets and investing in a diversified portfolio of alternative assets. During the session, you’ll learn about:

We’ll also be hearing from one of our members on how they’re utilizing Gridline’s Thematic Portfolios to help achieve their investing goals.

This webinar is open to Gridline Members. If you would like to join us, please complete the process to sign up for access, and we will send you your personal link to join the live webinar.

Happy New Year! Rather than reviewing the past, we wanted to take the opportunity to share our thoughts on the markets as we move into 2023, specifically where we see opportunity and why we believe that 2023 can be a banner year for alternatives.

We believe alternatives provide differentiated strategies to enhance returns, help reduce risk, and capitalize on opportunities not available through traditional investing channels. The current market conditions present investors with attractive opportunities to build a robust portfolio for the long term.

-Logan Henderson, Founder and CEO

The investing landscape changed dramatically in 2022 and investors need to adjust their strategies to serve them in a new investing environment. Read more.

The demand is growing for private credit strategies and it’s vital to understand how investments in private credit are positioned in the event of a downturn. Read more.

In our first member webinar of 2023, we’ll be discussing how you can enhance your investing strategy by moving beyond the public markets and investing in a diversified portfolio of alternative assets. During the session you’ll learn about:

We’ll also be hearing from one of our members on how they’re utilizing Gridline’s Thematic Portfolios to help achieve their investing goals.

This webinar is open to Gridline Members. If you would like to join us, please complete the process to sign up for access and we will send you your personal link to join the live webinar.

“Now is the time to rethink approaches to asset allocation, including re-underwriting one’s traditional fixed income allocation, to add meaningful return and diversification in a world where there is potential for a higher ‘resting heart rate’ for inflation.” – Kohlberg Kravis Roberts & Co.

As banks start to pull back from traditional lending, an opportunity arises for private credit funds to fill the gap in the market with better terms and a higher yield, all while sitting higher up in the capital structure.

For investors, you can look to private credit as a more inflation-resilient asset class. Replacing a portion of the income-generating sleeve of your portfolio with private credit offers the potential for diversification and attractive risk-adjusted returns; KKR’s loss-adjusted expected returns for private credit range from 11% to 15%.

As in private equity, manager selection remains one of the biggest drivers of returns in private credit. When we evaluate potential fund managers for the Gridline platform, we look closely at their track record and existing portfolio to ensure that they are consistently underwriting opportunities in which borrowers are well positioned to meet interest obligations even under uncertain macroeconomic conditions.

Some private credit funds also take a hybrid approach, enhancing their returns by taking small equity positions in the companies they lend to. Investing in these hybrid funds allows investors to supplement returns on the ledger’s fixed-income side while mitigating risk and generating predictable cash flow.

An excellent example of a fund utilizing this hybrid approach is VSS Credit Partners, which was recently available on our platform. VSS’s three previous funds ranked #1 in the Preqin Mezzanine category by Net IRR. As a hybrid private equity firm, it ranked in the top quartile for both the buyout and all private equity categories by Net IRR.

-Logan Henderson, Founder and CEO

A recession is a challenge that private investors are well-equipped to handle. There is value to be found in active managers who can adapt their strategies to current market conditions. Read more.

Active fund managers can position themselves to capitalize on companies that shift tactics during a downturn and to help their portfolio companies outperform the competition. Read more.

Earlier this month, the Blackstone Real Estate Income Trust Inc., more commonly known as BREIT, halted withdrawals as October redemption requests exceeded its monthly limit of 2% of net asset value and quarterly threshold of 5%.

The product has been one of Blackstone’s most significant growth drivers in recent years by targeting retail investors that are not large enough to invest in its traditional funds. And the fund has performed well, returning 13.1% annually since its inception six years ago.

As with other products, such as interval funds, often touted as a liquid alternative to traditional private asset funds, you must understand the limitations around redemptions and accessing liquidity.

Investing in these products is not the same as investing in public equities, even if they are often compared to one another. Gridline aims to provide transparency and clarity around investment risks, fees, and liquidity while eliminating the incentives brokers might get to push certain products.

Let us know what you think – please don’t hesitate to reach out.

-The Team at Gridline

“It’s important to stay consistently invested every single vintage year, which means you must think about asset allocation and make sure you know you’re not deploying too much capital today at the expense of tomorrow. Otherwise, you are making a huge bet on market timing.” – President, US-based Single Family Office

The number one driver of returns in private markets is manager selection, which is why we have a highly curated selection of rigorously vetted managers on our platform. As a result, the questions we get are often less about the quality of opportunities and more about where to invest, how much, and when.

Market conditions can impact private investments, and while volatility is not as severe in private markets as in public markets, private markets also go through cycles. Funds of a particular vintage may benefit from investing in a low-valuation environment (current market), while other vintages may have been deploying capital right before a crash (2019-2021 market). Attempting to forecast market conditions over a prolonged period is futile, and success would require exceptional foresight and timing.

As outlined in the quote above, the solution is consistently investing in a well-constructed portfolio diversified by manager, strategy, and vintage. When done well, this strategy becomes a form of dollar cost averaging for private investments that provide a stable return profile in all market conditions.

Our Thematic Portfolios are built to provide members the ability to construct a scalable investing program with vintage-specific, multi-manager funds, albeit with a fee structure more than 50% below traditional fund of funds.

Investing in multiple vintages of our Thematic Portfolios gives investors diversified sector and vintage exposure, access to leading private fund managers, and better economics.

-Logan Henderson, Founder and CEO

Investors with a long-term view should heed the lessons of the 2000s. During the “lost decade” for stocks, investors who held on to their public market portfolios saw them lose value in real terms. Read more.

Private market assets are often seen as riskier because it can take years to cash out. In reality, this illiquidity is a feature, not a bug, which allows investors to hold over market cycles and earn higher returns. Read more.

Campden Wealth recently released its comprehensive 2022 Family Office Report, a survey where the invested capital of the respondents averages $1 billion. Their top investment priorities are:

While many investors may not have yet reached the family office classification of wealth, an estimated 13 million US households qualify as accredited investors. Gridline answers these three priorities so that more people can apply the investment strategies of the ultra-wealthy to their own portfolios.

Let us know what you think – please don’t hesitate to reach out.

-The Team at Gridline

Last week we spoke with the Wall Street Journal about markdowns by VC/PE firms and concerns that they have been slow to take place. According to CB Insights, median tech company valuations declined across most stages in the third quarter of 2022, with the most significant impact in late-stage as series C valuations are down 21% and series D+ valuations are down 31% relative to 2021.

There have been some notable resets, such as the $6.7 billion fund Tiger launched in March 2021 having a 13% net IRR as of the end of June 2022, down from a 69% net IRR at the end of September 2021, but most fund marks aren’t publicly available.

From our perspective, many GPs have begun to mark down valuations in their portfolio, especially those that are in market with a new fund and need to have a defensible valuation when potential investors are conducting due diligence. Bringing new investors into a fund based on historical performance that will be reset over the coming quarters is not an ideal start to a new long-term relationship.

For example, a 2020 fund we evaluated with 40 investments has markdowns in approximately 12% of the portfolio. We expect that we’ll see markdowns impact 25-30% of portfolio companies over the coming quarters, but the severity of those markdowns will be drastically different by fund.

Understanding the entry valuation, current valuation relative to historical norms, and accounting for protection provisions, such as liquidation preference multiples and participation rights, allows you to allocate enterprise value between share classes and forecast a more accurate valuation and return profile.

If a fund will mark down 25% of the portfolio, but the “premium” paid at entry compared with historical norms is only 20%, the total markdown will be limited to 5%. Under the same scenario, the “premium” paid was 100%, which will yield a 25% markdown. Many headline-grabbing funds over the last two years were paying many times more than 100% of the historical norm, and the markdowns will be severe.

Investing is complex, and current market dynamics are all the more reason to rely upon professional diligence when evaluating potential investments.

-Logan Henderson, Founder and CEO

Investors who’ve written off private markets are missing out on a crucial tool for diversification and long-term growth. Read more.

Despite the allure of stock picking, the reality is individual investors consistently underperform market indices. Read more.

Hours into the epic meltdown of FTX this week, Sequoia Capital, who invested $214 million in FTX, announced they’ve marked the company down to $0.

Due to the diversification within a more extensive VC portfolio, overall fund performance remains “in good shape.”

This is why we believe in building a solid base of actively managed fund investments before pursuing a strategy of direct company investment.

Investor downside risk to a single business failure is mitigated when part of a more extensive portfolio of high-potential founders.

Let us know what you think – please don’t hesitate to reach out.

-The Team at Gridline

We often discuss return dispersion in alternatives compared to the public markets and how manager selection is key to delivering outperformance. We also talk about the potential of smaller managers to be an outlier as they are deploying capital into targeted strategies with a well-defined thesis and have the ability to contribute meaningfully to the success of their portfolio companies.

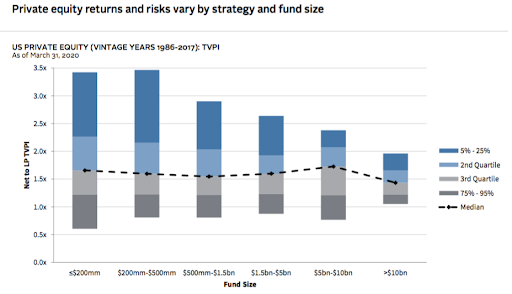

Taking this a step further and looking at the dispersion of returns, and risks, by fund size is an exciting exercise. The chart below analyzes the net returns of private equity managers over a 30-year period:

As you can see in the Cambridge Associates data, the median net return across all fund sizes has a relatively small variance of only 0.2x. Still, the upside potential of funds between $200mm – $500mm is 1.5x higher than the top-performing mega funds greater than $10bn. More importantly, the downside risk to capture that upside is minimal, as the variance between the poorest performing funds between $200mm and $10bn was only 0.3x.

What’s the key takeaway? While there tends to be a more perceived risk at the lower end of the market, the numbers tell a different story. Investing in funds at the smaller end of the spectrum allows you to have a similar risk profile to larger funds while providing the potential for higher expected returns, improving your return-risk ratio.

-Logan Henderson, Founder and CEO

The Halloween countdown begins as we show you ways to avoid these haunting investment mistakes. Read more.

From March 2009 to the beginning of 2022, we saw a highly unprecedented bull run in the stock market. Read more.

This week, we attended a family office conference where Ray Dalio spoke about the power of diversification for investing. One of Dalio’s fundamental investment principles is that “diversifying well is the most important thing you need to do in order to invest well.”

Diversification can improve your expected return-risk ratio more than anything else you do as an investor because while you can’t know which items you are betting on will provide better results; you know that they will behave differently. By mixing them appropriately, you can reduce risk. Asset classes, sectors, geographies, and investment strategies are the most critical variables for diversification. Regardless of which combination of these variables you prioritize, you will see the value of diversification play out.

Let us know what you think – please don’t hesitate to reach out.

-The Team at Gridline

Cathie Wood and ARK Invest closed out Q3 with the announcement of the ARK Venture Fund, a cross-over fund open to retail investors accepting commitments starting at $500. We fully support broadening access to private markets (our core business), but we have issues with how this is constructed and presented.

The Fund has a total expense ratio of 4.22%. This includes a 2.75% management fee, 0.65% distribution fee, and an additional 0.82% other operating fees. There is no carry, but it’s hard to justify a 4.22% fee relative to traditional funds, which according to the recent MJ Hudson Private Equity Fund Terms Research, had fund management fees in the 1.76% – 2% range. Assuming a 5.0% annual return (per the prospectus) over ten years, an investor would generate a 63% gross return. When factoring in the fees, the return drops to 19%, a 44% difference.

Investing in the private markets is very different from public markets, and investing in the early stage vs. late stage is also very different. Each strategy requires a unique skill set, and most managers have been unable to do both. “The Fund’s investments will include early- to late-stage private companies and micro-, small-, medium- and large-capitalization public companies. Under normal circumstances, the Fund expects to invest 20% – 85% of its assets in securities of private companies and the remainder of its assets in publicly traded securities.” A manager’s investment process & philosophy (two of Gridline’s four P’s of Manager Selection) must be well-defined and focused. This is a vast landscape to cover, analyze, and win the best opportunities in technology.

The fund is structured as an interval fund. This closed-end fund is not listed on an exchange but periodically offers to repurchase a limited percentage (between 5% and 25%) of outstanding shares. Interval funds are often touted as a liquid alternative to traditional VC & PE funds. Still, as the prospectus states, “it is expected that the Fund will offer to repurchase only the minimum amount of 5% of its outstanding Shares.” No matter the circumstances (poor performance, manager turnover, personal financial situation, etc.), only 5% of the fund can be liquidated per quarter, meaning it could take five years to get your money out.

We cheer innovation in private markets, but as with all investments, robust diligence and thoughtful analysis are required before committing. This new fund may be incredibly successful, and we hope it is for anyone who chooses to invest. Still, we stand firm in our belief that managers with unique perspectives, strong portfolio management skills, a well-documented investment process, and a high degree of economic alignment with investors are the key to winning in the private markets.

Investors need access to a range of high-quality opportunities that originate from a comprehensive market analysis. Read more.

While old-school processes may have been enough in the past, today’s investors need a modern solution designed for the future of investing. Read more.

According to the Preqin Special Report: The Future of Alternatives in 2027, the alternative assets industry will hit $23.3 trillion in AUM worldwide by the end of 2027, up from $13.7 trillion in 2021.

The forecasted 9.3% growth shows the strength of alternatives as an asset class, even with a low global GDP growth forecast of 3.2% this year and 2.9% in 2023.

It is expected that venture capital will be the fastest-growing asset class, increasing to $4.2 trillion in assets, followed by private equity, which is expected to reach $7.6 trillion by 2027.

As the denominator effect requires many institutional investors to throttle new private market allocations, much of the forecasted growth is coming from the retail investor market, reinforcing the growing demand for private market investment opportunities by individual investors and their advisors.

Let us know what you think – please don’t hesitate to reach out.

-The Team at Gridline