Over the course of this year, we’ve added a variety of new features to the Gridline platform as we continue on our mission to add efficiency and transparency to private market investing. Here are just a few of our favorites:

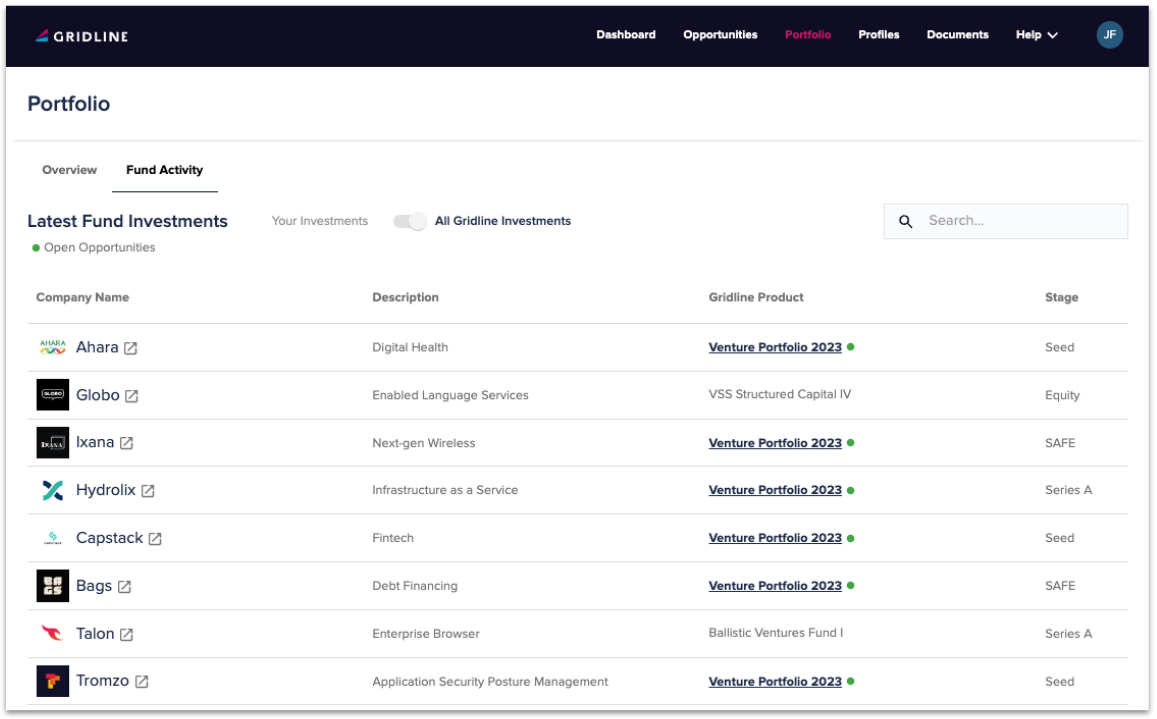

Fund Activity View

See all of the individual companies that your dollars are invested in. Haven’t invested yet? You can still see all portfolio companies across the funds currently and previously available on the Gridline platform.

Equity Trust Integration

Quickly and easily create and invest from a self-directed IRA with our integration to Equity Trust. You can both open and fund your account straight from the Gridline platform, either before investing or while creating your investment.

Fund Manager View

See a comprehensive list of all fund managers that Gridline is working with, including those previously listed for investing. This view allows you to explore the full catalog of opportunities, including managers who are only available in our Portfolio products or managers who may not be in the market currently but are likely to come back onto the platform with their next fundraiser.

Additional new features include:

- A refreshed and improved user experience across the entire platform, including improved mobile responsiveness

- The ability to request additional commitments on existing open investments

- User management for Advisor members

- Automated capital call reminders

And we aren’t done yet…

Stay tuned for the following updates coming in 2024

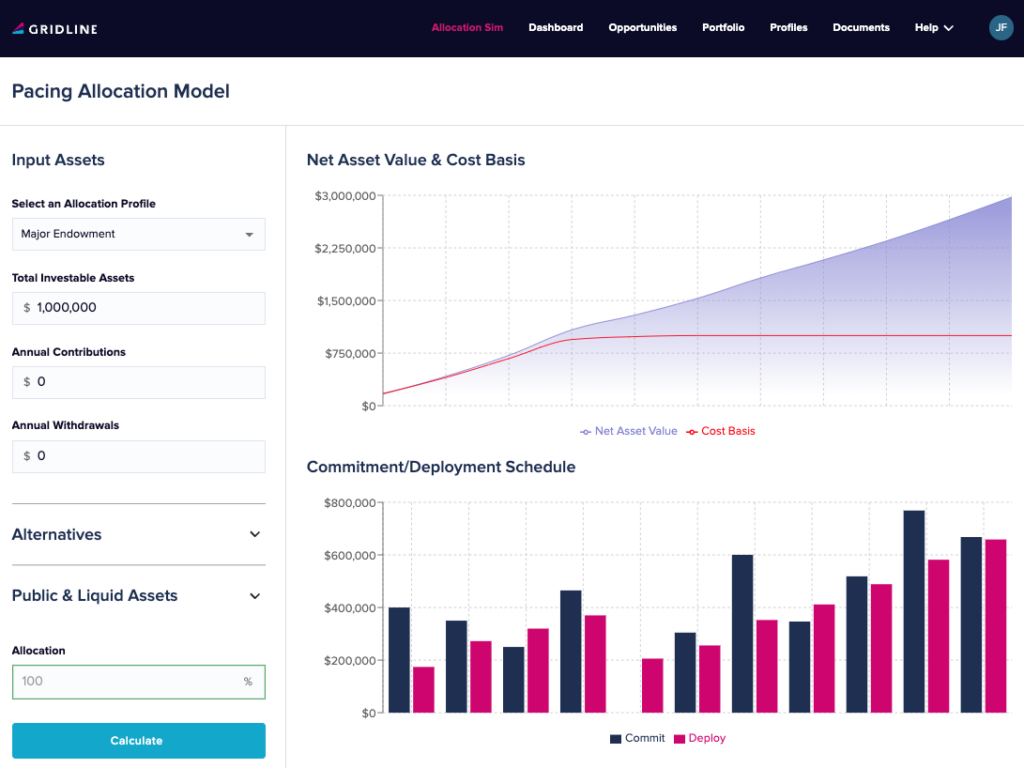

Allocation Simulator

Understanding pacing and commitments across an entire portfolio can be challenging, but soon, you’ll be able to visualize commitments, cash flow, and projected portfolio growth with our new Allocation Simulator.

Custom Fund Solutions for Investment Advisors

Gridline’s turnkey solution provides a range of features designed to simplify the launch and management of your own custom fund. From KYC to K-1, we provide a superior investing experience for you and your clients.

Book a time to speak with a member of our team to learn more, or sign up in minutes to gain access to the platform.