Happy holidays! I’m Charles, taking over for Logan in this edition of our newsletter. We wanted to take this opportunity to review our 2023 predictions and grade our predictive performance. We think we did a pretty good job, given that 2023 was a volatile year for investing, but we’ll let you be the judge.

Private debt will fuel leveraged buyout markets: A

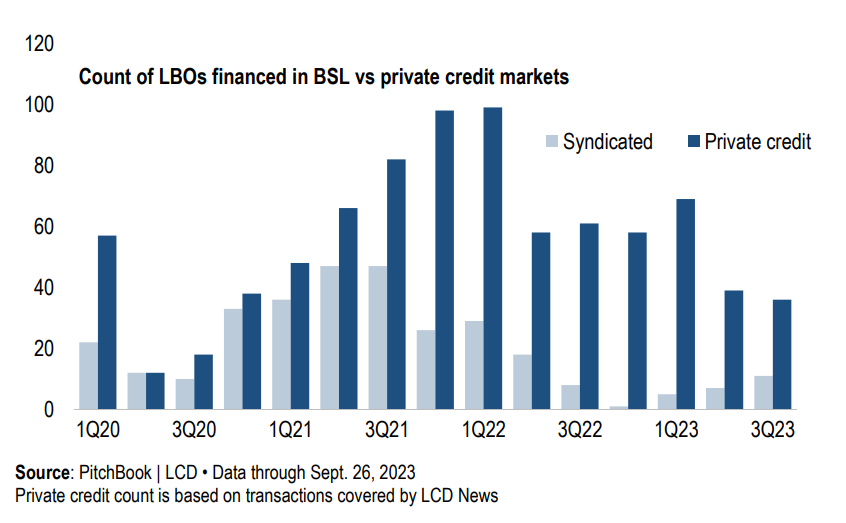

In January of last year, the writing was on the wall that banks were not going to be able to extend the type of credit that they did in the lower rate environment of 2020-2022. The collapse of Silicon Valley Bank, Signature, and other mid-sized banks accelerated this trend. This meant that every surviving bank smaller than the behemoths focused on shoring up their own balance sheets rather than lending more aggressively. The best data on this comes from PitchBook LCD, which tracks loans used to fund buyouts from private credit and the syndicated markets preferred by banks. Their Q3 update showed that the gap between buyouts financed by private credit and syndicated loans was at its widest point ever in 2023, and their figures likely understate the extent of the transition as they only track larger deals.

Midmarket companies will dominate take-private opportunities: B+

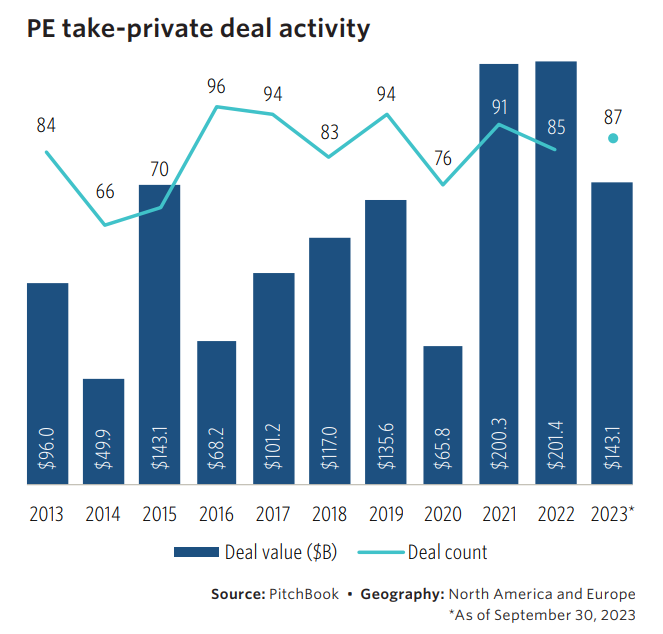

Take-private transactions in 2023 are even with 2022’s figures through 3 quarters by count and running a bit behind on dollars (numbers courtesy of PitchBook). That’s because deals in 2023 were slightly smaller than the past couple of years, a trend that accelerated in Q3 as 2/3rds of take privates were under $1B against a long-term average of 55%. Large take privates have not disappeared, though, evidenced by deals over $10B for Toshiba, Worldpay, and Qualtrics.

Sponsor-to-sponsor transactions will be the primary source of private equity exits: B

Sponsor acquisitions held steady in 2023 per PitchBook at 44% of exits, as corporate buyers continued to snap up PE-backed firms rapidly. Our rationale for sponsor-led acquisitions was sound, though, as the IPO markets remained largely closed, and only 1% of exits were to the public markets.

The continued rise of protection provisions in VC deals: A

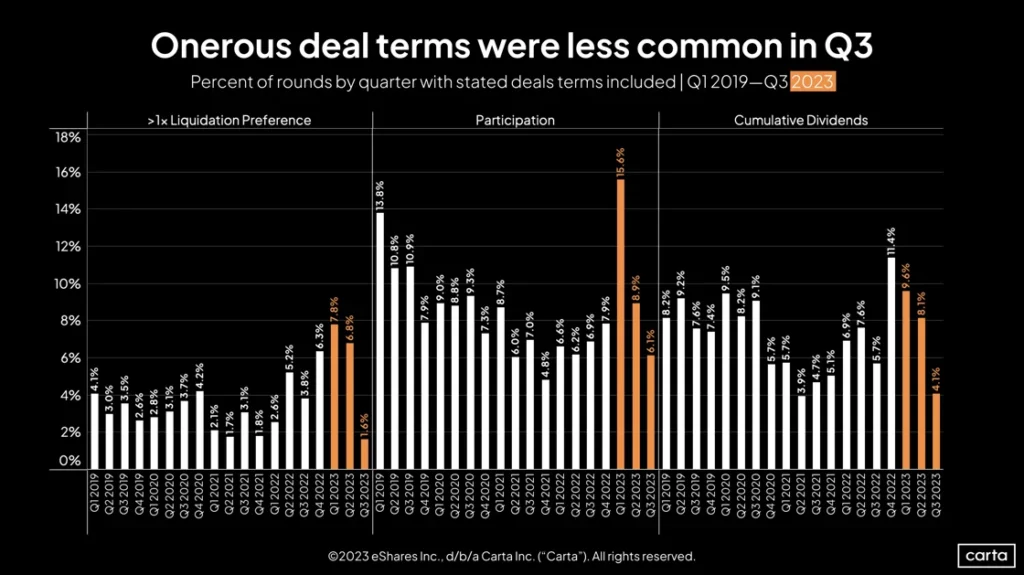

The best data source here is Carta, which publishes a quarterly report on venture trends using the proprietary data they have on over 41,000 venture-backed firms. The graph below shows the percentage of deals in a given quarter that included three common protection provisions: a liquidation preference, participation, and cumulative dividends. All three effectively allow venture capitalists to capture more of the value from a company’s exit if that exit is less than a home run. These terms either reached or neared cyclical highs in the first quarter of this year, a sign that venture investors were interested in protecting their downside. Founders were willing to accept them because they wanted to avoid a drop in headline valuations, though as the year wore on, more founders became willing to accept a lower valuation rather than load up the deal with protection provisions. The numbers below likely understate the extent of the shift, as the later-stage deals that more often include protection provisions were less common while early-stage deals held steady.

Real Assets face headwinds but have strategic opportunities: B

The headwinds definitely came for real assets in 2023 in the form of higher interest rates, which sent home sales tumbling to post-financial crisis era lows. This had a knock-on effect on private real assets fundraising, which followed a bumper year in 2022 with “the worst fundraising market in a decade.” The strategic opportunities in the space have indeed opened up, as areas like industrial outdoor storage and cell towers continue to see healthy demand.

In January, we will publish our quarterly outlook for Q1 2024. Until then, have a safe and happy holiday from everyone here at Gridline.

-Charles Patton, Investment Team

Investment Opportunities

To view and download full details of the funds on our platform and in future emails like these, visit app.gridline.co/signup and answer a few quick questions that allow us to verify your identity and learn about your allocation strategy. There is no cost or commitment to create an account on Gridline.

Worth a Read

The Potential of GP Stakes Investing in the Private Markets

Discover GP Stakes Investing: a unique blend of growth and stability for private market investors. Dive further into this innovative strategy with Gridline’s insights. Read more.

A Final Thought

This past year, our engineering team rolled out dozens of innovations that improve private market investing.

These include features that provide greater portfolio transparency, like our Fund Activity View, as well as innovations that our investors don’t always see, like automated fund administration. Together, this allows us to create a world-class investor experience along with industry-low fees and minimums.

A perfect example of the streamlined investing experience we’ve created is that in 2023, on average, it took investors just 4 minutes to complete an investment from start to finish, including receiving funding instructions.

We look forward to continuing to deliver on our mission of delivering an unparalleled private market investing experience in 2024.

– Peter Bilali, VP Platform