As an investment strategy, diversification is nothing new. It’s about as old as investing itself. The basic idea is simple: don’t put all your eggs in one basket. But while diversification is a well-understood concept, it can be challenging to achieve in practice – especially concerning private equity. Direct investment in private equity funds often requires a minimum investment of $25 million or more, making it prohibitively expensive for smaller investors. And even for more prominent investors, researching, selecting, and monitoring individual funds can be time-consuming and resource-intensive. That’s where funds of funds come in.

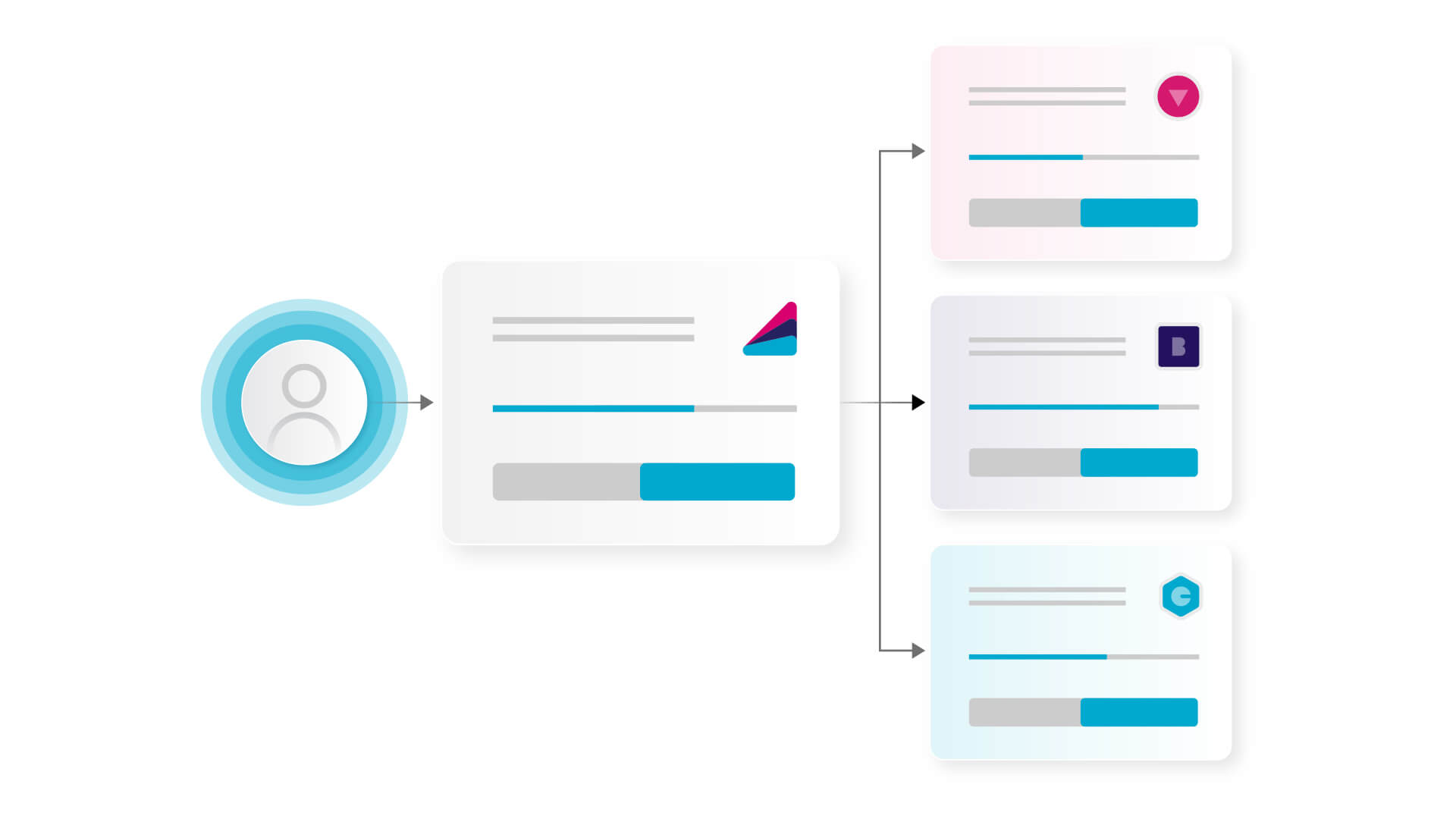

A fund of funds (FoF) is an investment vehicle that gives investors access to a diversified portfolio of private equity funds. By pooling together capital from several investors, a FoF can invest in several private equity funds spanning various sectors, asset classes, and geography.

Let’s explore the three key benefits of FoF.

1. Cost-effective diversification

One of the most significant advantages of FoF is that it allows investors to achieve diversification at a lower cost than if they were to invest directly in private equity funds.

In 1975, John Bogle – the founder of Vanguard – began the first index fund to track public equities. Today, index funds are a popular way for investors to get exposure to a wide range of stocks at a low cost.

Four years after Bogle launched his index fund, Adams Street Partners – a private equity firm – established the first FoF to give institutional investors access to a diversified portfolio of private equity funds.

By 2009, FoFs accounted for around an eighth of the global capital raised by private equity funds. And while there are several different types of FoFs, they all share one key advantage: they offer investors cost-effective diversification.

2. Expertise in fund selection and monitoring

Selecting and monitoring individual private equity funds can be complex and resource-intensive.

From geo-diversity and sector focus to investment style and vintage year, there are a lot of factors to consider when selecting a private equity fund. And with new funds launching all the time, it can be hard to keep up with the latest developments.

FoFs can help investors to navigate this complex landscape, giving them the confidence that they’re making the best possible investment decisions. This is particularly important for investors who don’t have the internal resources to do this themselves. By working with a FoF, they can access the expertise they need.

3. Access to otherwise unattainable investments

Another key benefit of FoF is that it gives investors access to investment opportunities that they might not be able to access if they were investing directly.

This is because FoFs typically have well-established relationships with leading private equity firms. When a new fund is launched, a FoF is often one of the first to get access.

FoFs often have privileged access to co-investment opportunities, investments made alongside a private equity fund in a specific portfolio company. These opportunities offer attractive terms, such as no fees or interest.

So there you have it: three critical benefits of FoF. Whether you’re looking to diversify your portfolio or access otherwise unattainable investments, a FoF could be the right investment solution. Gridline makes it easy for you to invest in a FoF with lower capital minimums, transparent fees, and significant liquidity.