Did you know that most of the assets under management at endowments are invested via external investment managers? According to Cambridge Associates, among endowments greater than $3 billion, the median number of external managers was 136, investing across 270 different vehicles. At the opposite end of the spectrum, the median for endowments less than $200 million was 27 managers, investing across 36 different vehicles.

To build this type of portfolio yourself, it would require over $35 million in investments assuming a conservative $1 million minimum commitment.

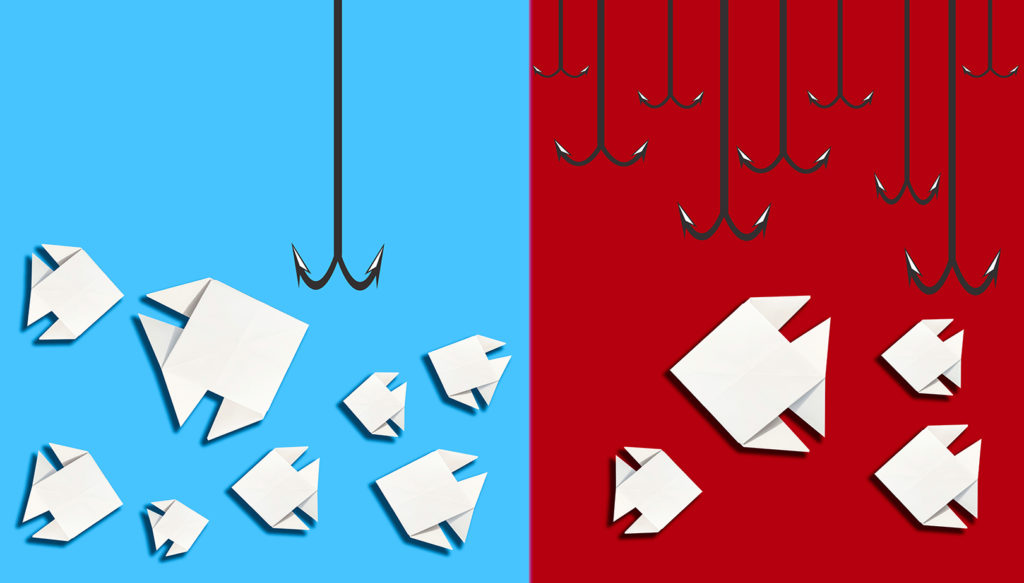

Unlike the public markets, where investors can purchase an index fund to gain exposure to an asset class, there are no investable private market indexes for broadly-diversified exposure to the private alternative asset classes.

We’ve built our Private Alternative Portfolios to help individual investors achieve the same multi-asset, multi-manager, multi-vintage strategy that endowments have been leveraging for the past +30 years to drive outperformance.

Now, individuals are able to replicate portfolio construction of leading institutional investors, but with more accessible investment minimums, an institutional-level of selection and diligence, and most importantly, access to top-tier fund managers.

-Logan Henderson, Founder and CEO

Worth a Read

Why Smaller Funds Are Increasingly Attractive as Dry Powder Soars

Investors seeking superior returns should consider investing in smaller private equity funds. Read more.

Comparing Liquid and Illiquid Alts

Liquid alts are mutual funds or ETFs that provide diversification and downside protection through exposure to alternative investments. Read more.

A Final Thought

Since 1996, the number of US public companies shrank from 7,300 to 4,800, while PE-backed private companies grew from 1,600 to 10,100.

Last week The Wall Street Journal reported smaller companies have made up the bulk of buyout targets even as multibillion-dollar deals captured headlines.

“Buyout firms owned more than 10,000 US companies as of June 30, up from fewer than 2,000 in 2000, according to PitchBook. Some 80% of those companies are valued at between $25 million and $1 billion, a percentage that remained consistent over the past 20 years even as the industry ballooned.”

With about a third of the S&P 500 index often consisting of just ten companies, buyout funds are increasingly becoming a more essential portfolio allocation to build broad diversified market exposure.

Let us know what you think – please don’t hesitate to reach out.

-The Team at Gridline