You know the pain if you’ve ever invested in alternatives.

The process — even in 2021 — is pretty old school. You hit up your network to try to see what opportunities are out there. Once you’ve picked one, it’s time to go through the litany of forms you’ve signed a thousand times before, from fraud prevention to subscription to authorizing transfers.

It gets even worse after you make your investment. Reporting is non-standard and all over the place, with erratic capital call frequencies. It can be nearly impossible to track unfunded commitments, with your best bet being a spreadsheet you have to manually update. There’s no way to accurately and comprehensively view your portfolio of alts.

These are the headaches Gridline aims to solve. If you think about our marketplace as the on-ramp to alternatives, the technology that digitizes a previously manual process serves as the rails. From filling out your investor profile to signing legal documents to getting a dashboard view of your alternative investments, we’re making the whole process quick and seamless.

Discover Your Next Investment

Inside our marketplace, we’ve made it easy to narrow down your options and see what investments align with your goals. What used to take months of networking and negotiating allocations can now be done in a few clicks.

We made it easy to drill down on the key decision points that are most important to you: Is the fund focused on early or late-stage companies? Is it run by an emerging or established manager? Maybe you want a manager who has experience at KKR or got an MBA at Harvard.

Eliminating Paperwork

One of the biggest headaches with alts remains all the paperwork. Every time you make an investment, you’re likely filling out the same 30-page form you did for the last one. While digital signatures have become more common, the whole process still feels pretty antiquated.

Gridline streamlines the entire documentation process from start to finish. When you sign up, we’ll collect the basic information and perform instant verification to comply with Anti-Money Laundering and Know Your Customer (KYC) regulations.

That saves us (and you) a lot of time later when you make your first investment. We’ll pre-fill the subscription documents with the details you already provided and you’ll be able to sign them digitally right within the Gridline platform. There’s no jumping to another website or having to download and scan documents to email in.

Once you make your first investment, all the information you’ve provided can be used for follow-on investments, meaning you’ll never have to fill out a lengthy subscription agreement again.

Tracking Performance

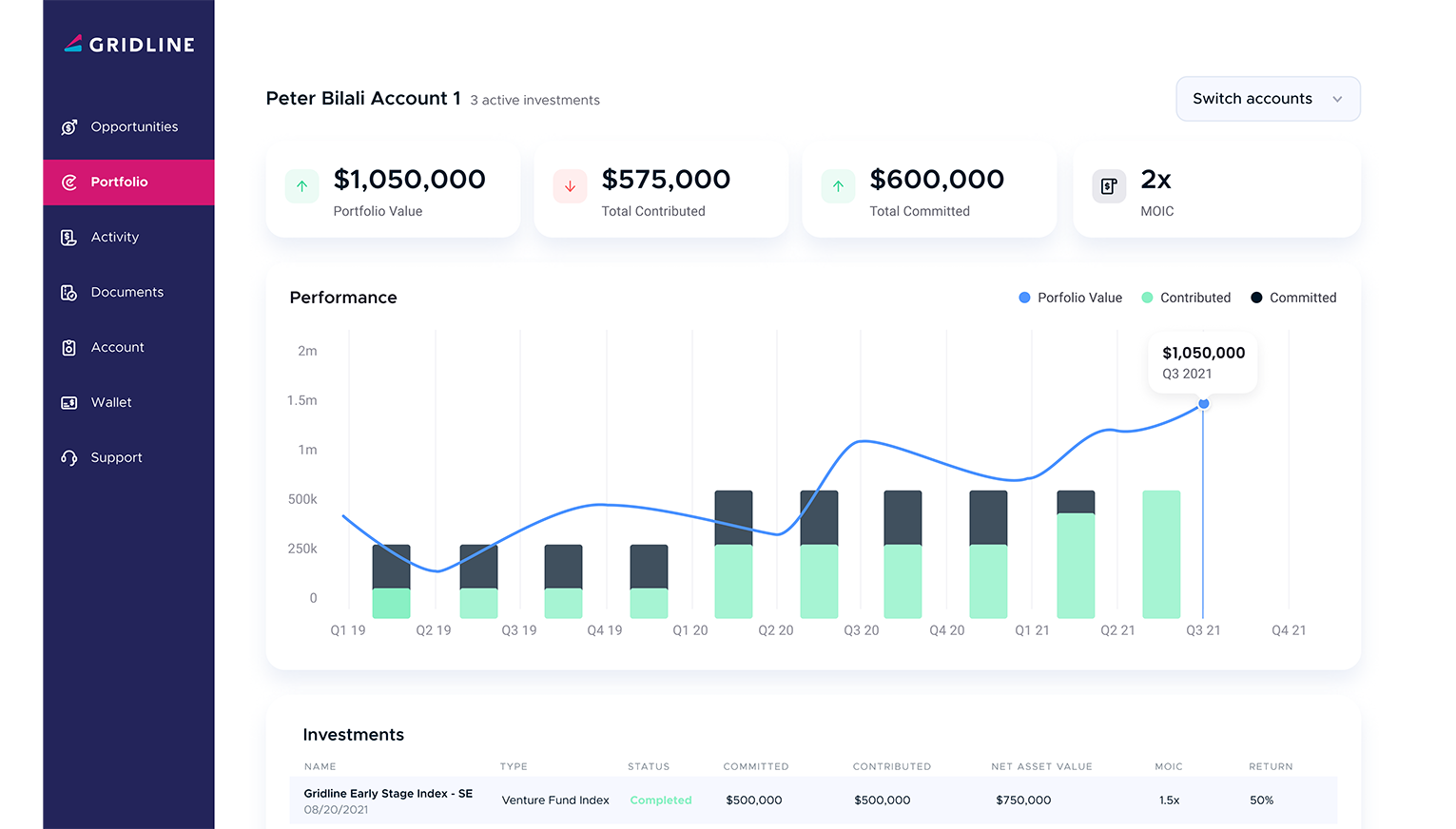

One of the trickiest parts about Alts is having a sense of performance after you invest. There’s no reporting standard across funds, making it difficult to get a unified view of your portfolio and see what your total contributed and committed investments are.

We’re making it easier to track this data by normalizing all the non-standard performance reports you get from funds and putting it into a dashboard. At a glance, we help you see everywhere you’re invested as well as a summary of what capital has been committed and called. You can drill down into investment-specific data to see how it’s doing over time and call up documents related to it. You’ll be able to quickly see notable investments a fund has made and an aggregated newsfeed that pulls in the latest headlines on portfolio companies.

These innovations are how we’re completely digitalizing the alternative investment experience with the features and functionality you expect from consumer-grade investing apps. There’s no reason accredited investors can’t have the research, digital signing and easy transfer setup that millions of public market investors already have.