We often discuss return dispersion in alternatives compared to the public markets and how manager selection is key to delivering outperformance. We also talk about the potential of smaller managers to be an outlier as they are deploying capital into targeted strategies with a well-defined thesis and have the ability to contribute meaningfully to the success of their portfolio companies.

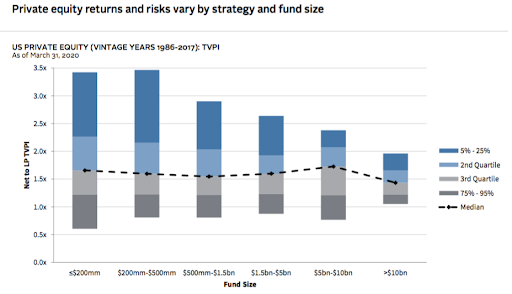

Taking this a step further and looking at the dispersion of returns, and risks, by fund size is an exciting exercise. The chart below analyzes the net returns of private equity managers over a 30-year period:

As you can see in the Cambridge Associates data, the median net return across all fund sizes has a relatively small variance of only 0.2x. Still, the upside potential of funds between $200mm – $500mm is 1.5x higher than the top-performing mega funds greater than $10bn. More importantly, the downside risk to capture that upside is minimal, as the variance between the poorest performing funds between $200mm and $10bn was only 0.3x.

What’s the key takeaway? While there tends to be a more perceived risk at the lower end of the market, the numbers tell a different story. Investing in funds at the smaller end of the spectrum allows you to have a similar risk profile to larger funds while providing the potential for higher expected returns, improving your return-risk ratio.

-Logan Henderson, Founder and CEO

Worth a Read

Top Five Investment Mistakes That Could Haunt You For Decades

The Halloween countdown begins as we show you ways to avoid these haunting investment mistakes. Read more.

Why the Last Stock Market Bull Run is Unlikely to Repeat

From March 2009 to the beginning of 2022, we saw a highly unprecedented bull run in the stock market. Read more.

A Final Thought

This week, we attended a family office conference where Ray Dalio spoke about the power of diversification for investing. One of Dalio’s fundamental investment principles is that “diversifying well is the most important thing you need to do in order to invest well.”

Diversification can improve your expected return-risk ratio more than anything else you do as an investor because while you can’t know which items you are betting on will provide better results; you know that they will behave differently. By mixing them appropriately, you can reduce risk. Asset classes, sectors, geographies, and investment strategies are the most critical variables for diversification. Regardless of which combination of these variables you prioritize, you will see the value of diversification play out.

Let us know what you think – please don’t hesitate to reach out.

-The Team at Gridline