The stock market downturn has created a compelling buying cycle for private equity firms, namely through the ability to take public companies private and acquire companies that were planning to go public. While some companies may not be receptive to these transactions in the near term, anticipating that their valuations will recover, we are starting to see how the current market dynamics will yield opportunities.

- Last week, Zendesk announced a consortium of private equity firms had acquired it for $10.2 billion, a substantial discount to the $17 billion offer the company rejected in February of this year.

- Through the first six months of 2022, only two IPOs on U.S. exchanges have raised more than $500 million, and the backlog of companies that have filed with the SEC to go public in the past year sits at 185.

The time a company stays private has significantly increased, with listed software companies taking an average of 9 years before going public. Additionally, the rapid repricing of software valuations and a falling share price can lead to management choices today that run counter to perspectives a short time ago. The piles of private money (dry powder) waiting to be deployed is substantial. It creates an opportunity for investors to realize some of their returns, albeit at a steep discount to what they may have gotten during the last two years.

The winner in this cycle will be private equity firms and their investors, which can capitalize on the opportunity to buy companies with a solid long-term trajectory that a market dislocation has hampered.

-Logan Henderson, Founder and CEO

Worth a Read

3 Key Benefits of Funds of Funds

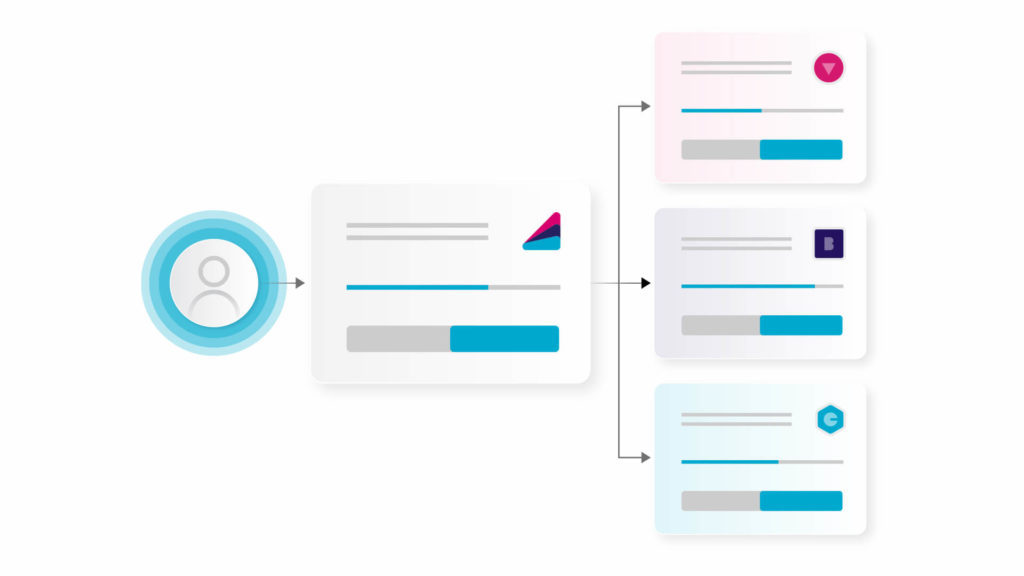

A fund of funds is an investment vehicle that gives investors access to a diversified portfolio of private equity funds. Read more.

How RIAs Can Offer Clients the Investments and Returns They Want

One option is to invest more heavily in alternatives, such as private equity and venture capital. Read more.

A Final Thought

In their recently published 2022 Global Family Office Report, UBS found that:

- 74% of those surveyed will likely increase their private equity investments over the next three to five years.

- There has been a 44% increase year over year of family offices that expect to grow allocations to funds of funds to diversify risk across managers, strategies, and vintages.

- 80% of US family offices expect increased staff costs related to strategic asset allocation, risk management, and reporting.

Gridline sources institutional-level opportunities and performs methodical due diligence to enable investors and family offices alike to create outsized private equity returns while reducing the internal burden of private market investment and administration.

Let us know what you think – please don’t hesitate to reach out.

-The Team at Gridline