Private markets are becoming a bigger part of the investment conversation among the fastest-growing RIAs, and a material driver of HNW and UHNW portfolios. Transparency and reporting quality now outrank track record as the #1 expectation LPs have from GPs (SS&C, Embracing the New).

Advisors are facing the same demand as they expand oversight in private markets. Today, they’re designing more sophisticated allocations, overseeing more fund exposure, and navigating more complexity than ever before. And they’re partnering with intelligent infrastructure that delivers the white glove service their clients demand and the operating levels their firm’s scale requires. Whether you’re managing a few funds or a firm-wide alts program, here’s a simple checklist to help you evaluate your current oversight and what “great” can look like when your infrastructure matches your ambition.

The Modern Private Markets Oversight Checklist

Ask yourself: Can I…

□ See positions, performance, and capital flows in one clear view?

Instead of piecing together PDFs or spreadsheets to understand your private investments, a modern platform can collect, store, and standardize all of your fund documents and data, providing NAV, IRR, DPI, commitments, capital calls, and distributions in one place, continuously updated and reconciled across every fund and client. View performance instantly at the firm, client, or fund level, with metrics that are continuously updated and ready to share.

→ Real-time performance visibility and drill-down reporting fuel better conversations and smarter decisions by putting a complete, organized picture at your fingertips anytime you need it.

□ Eliminate manual work across reporting, compliance, and audits?

Documents and data can be centralized and reconciled automatically. From clean, client-ready reports to audit trails and compliance workflows, a modern platform is designed to remove friction, so you can focus on managing strategy, not formatting spreadsheets.

→ A back office that scales as smoothly as your investments keeps growth sustainable and creates more room for high-value client engagement and strategic planning.

□ Be client-ready without the scramble?

Advisors don’t have to dig through a lengthy diligence document to understand why a fund is unique, they can have a short document that lays out the key points to answer client questions. Similarly they don’t have to compare two quarterly reports side by side, they can have a straightforward summary that provides key talking points without sifting through dozens of pages.

→ Confidence comes from a quick read through the right information, rather than sifting for what you really want.

□ Integrate with the systems I already use?

Your private market platform can integrate with the reporting, billing, and custodial systems your team already relies on—like Orion, Black Diamond, Schwab, and Fidelity—to deliver a unified, end-to-end experience.

→ Integration makes private market investing feel as seamless as the public side while ensuring your team and clients always work from the same accurate, up-to-date information.

This is what better looks like

Oversight doesn’t have to slow you down—it can set you apart. The fastest-growing advisors are raising the bar, not by working harder, but by leveraging infrastructure built for what private markets demand.

Gridline is setting a new standard for private market oversight.

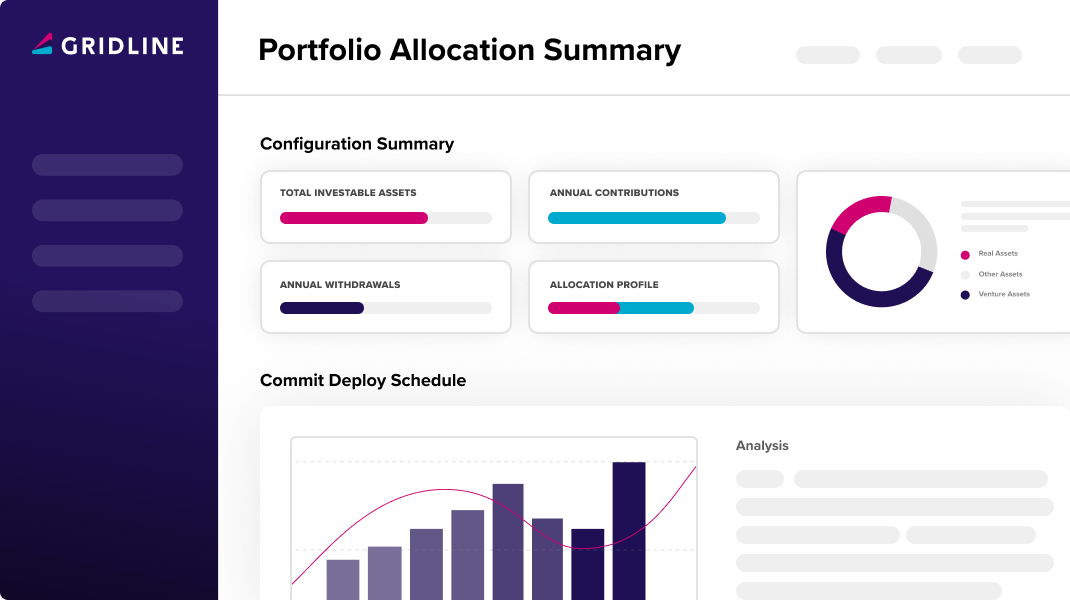

We’re bringing the transparency and reporting ease you’d expect from public markets to your alternatives portfolio with dedicated help on sourcing and structuring challenges unique to private markets. Designed as a Turnkey Alternatives Management Platform, Gridline rearchitected the entire system so you can give clients a clear, unified view of what they actually own.

Most legacy platforms were built to raise capital for fund managers, not to help advisors build and manage an alternatives portfolio. Gridline was purpose-built for advisors, streamlining the entire process, from portfolio construction to reporting. Its unified dashboard tracks capital calls, distributions, and NAV in real time, with AI-powered reconciliation and automated workflows that eliminate manual drag, so you spend less time preparing for meetings and more time showing up client-ready with comprehensive, up-to-date insights.

Whether you’re overseeing a few LP positions or scaling a full alts program, this checklist is a practical place to start elevating your oversight without adding complexity.

Gridline, LLC is a technology platform and the owner of the software platform referenced herein. Gridline Advisors, LLC, is a Registered Investment Advisor registered with the state of Georgia. The content in this post is for informational purposes only and is not an offer to sell or a solicitation to buy any security. Alternative investments are speculative, involve a high degree of risk, including the possible loss of your entire investment, and are not suitable for all investors. Past performance does not guarantee future results. Interests in funds managed by Gridline Advisors, LLC, are available only to accredited investors. This material may contain forward-looking statements; actual results can vary materially.